For those who can afford it, a Cypriot residency is not a plan b, a travel document, or a lifestyle choice. It is a brand that tells you that your family has the right to belong to a country that offers unlimited intergenerational freedom and wealth protection in a society of like-minded high wealth entrepreneurs. While your yacht, your sports vehicle, or mansion can be taken away by your government, your Cypriot residency is an eternal investment for your family and your children to protect your legacy and your asset. It is an investment in your future.

Amongst the numerous benefits, applicants have the fastest processing times among the EU RBI programs. You get direct residency for a €300,000 investment that can bring significant returns considering the state of Cypriot funds and the real estate market

Seeking to stimulate the economy through investment and job creation, Cyprus offers foreign nationals an opportunity to obtain permanent residence in Cyprus through investment. This is an incredible opportunity for non-EU foreigners that wish to live in the EU. The process is quite fast, as the approvals can be granted in three months.

What is best: applicants are not required to live in Cyprus continuously before or after residency approval, there are minimum requirements conducted by banks of disclosing the source of wealth, there is no medical testing and no language requirements.

This means that obtaining a Cyprus permanent residence is a wonderful opportunity for investors, business executives that are active worldwide, and are seeking alternative residency that will allow them to have a more stable and friendly international tax planning.

In Mundo, we believe the Cypriot RBI program is perfect for investors from all over the world. Why?

1. A gate for EU investment:

Most Latin Americans, Africans, and people from the US can travel to the EU without a visa. Nevertheless, if they want to invest in the EU and open businesses, they need infinite visas and permits. Having a Cypriot residency avoids some of these bothersome processes, which can be lengthy and costly in many countries.

2. Quick and easy process:

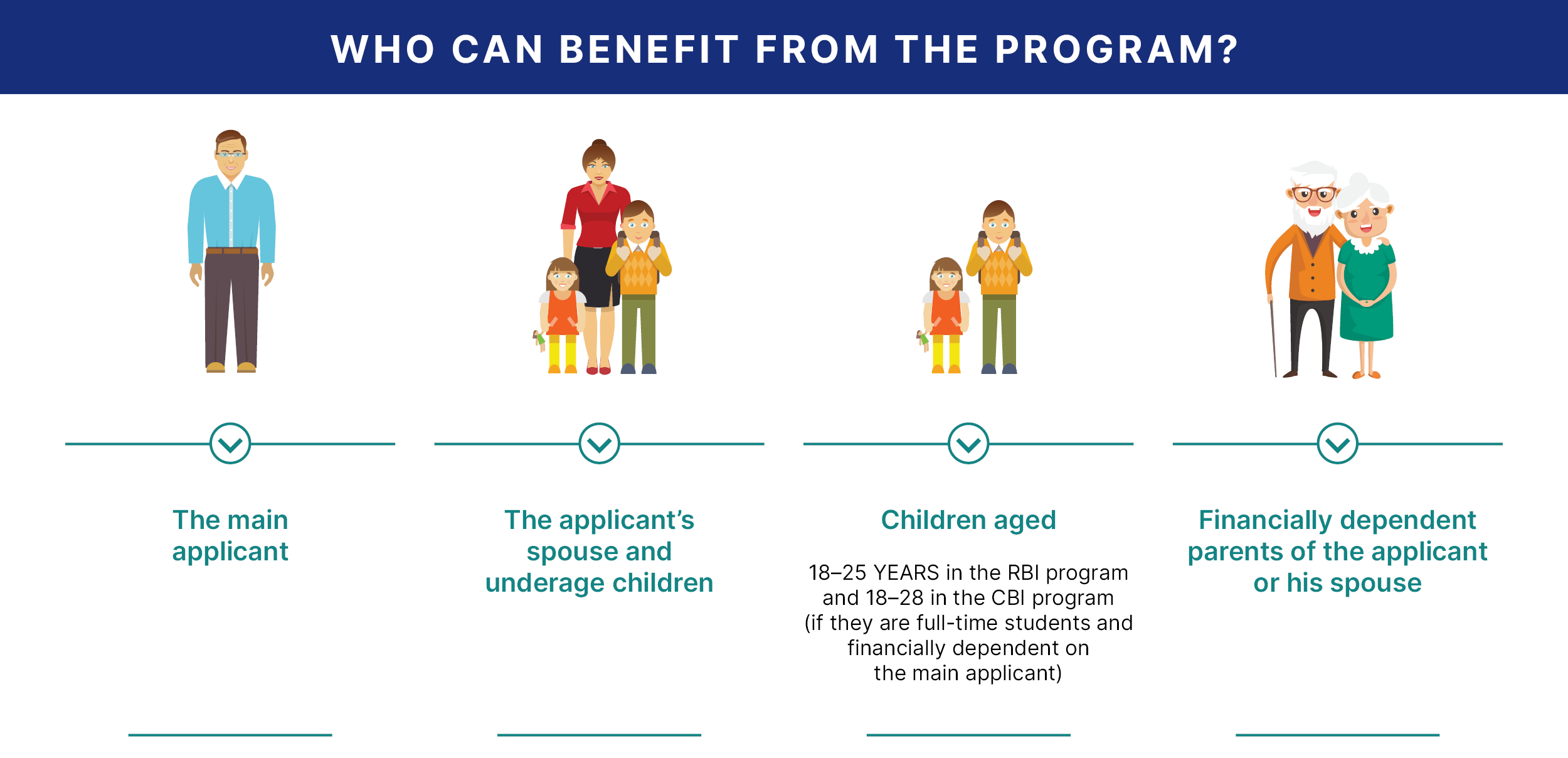

The procedures don’t have never-ending requirements and are fast: if you apply for residence, you’ll receive a response in around 90 days. Also, you can include your spouse, dependent children up to 25 years old, and even your parents.

3. Not many questions and not many requisites:

You are not mandated to live on the island before or after the approval; there are minimum wealth disclosure requisites, and there are no medical testing or language exams.

4. Fantastic relocation destination:

Even as applying for the RBI only requires you to go to Cyprus once every two years, the country also has many other lifestyle pros. It’s a terrific place for business, living, or tourism. 70 % of the inhabitants speak English, half of the population has graduate degrees, and it’s a gorgeous island with some of the best beaches you’ll ever see, and a 10,000-year-old history.

Even if the country is small, you won’t get bored. It has an astonishing nightlife, plenty of outdoor attractions, archeological settings from its antique Greek past, and more. The island has promoted itself as a year-long touristic place, it is not full of tourists all over the place.

5. Top-level life quality and lifestyle:

The cost of living on the island is among the lowest in the EU, especially when you compare it with the wonderful life and services the country has. Living in Cyprus costs just a bit more than in most Latin American major cities, but with better services and lifestyle. And it costs less than most American cities but with a way calmer ambiance. All that earned Cyprus to be named the 5th best relocation place in the world by a Knight Frank report. That’s why Cyprus has the second largest percentage of resident foreigners in the EU, with almost 20 %.

6. Tax residency benefits:

Even as the citizenship and residency programs don’t directly give you tax residency, you can get it by spending 60 days in Cyprus, under certain conditions. Setting your tax residency in Cyprus has fantastic benefits, mainly if you consider the tax burden of most Latin American countries and the US. Non-dom residents receive a 50 % tax exemption, if their income is more than €100k, for their first five years and an exemption of the Defense Tax.

You can check all the benefits in our Cyprus Citizenship and Residency by Investment article.

Residency

|

Minimum investment |

€300k

+ VAT real estate investment (€200k paid prior to the application). |

|

Requirements |

Five-year

foreign-sourced €30k deposit Yearly

foreign income of at least €30k (+5k per dependent child and €8k per

dependent adult) Clean

criminal record No

frozen assets within the EU |

|

Time |

2-3 months |

|

Notes |

You

must visit the country at least every two years You

cannot work in the country, but you can own a company |

|

Beneficiaries |

Main

applicant Spouse

and underage children Children

between 18 and 25 years old if they are 1) Not married, 2) Financially

dependent on the applicant, 3) Full-time students. Financially

dependent parents of the applicant and/or his spouse |

The minimum investment for the residency program is a €300k real estate investment, as we said. The purchaser does not have to be personally present when making the purchase, as it can be conducted through a legal representative. The fast-track residency program offers a path for citizenship after seven years if the individual has spent at least 180 days per year in the country. Another requisite is that the applicant must keep a five-year fixed deposit account from foreign sources in a national bank of at least €30k and must proof he has a secured annual foreign income of the same amount. You must also add €5k for each dependent child and €8k for each dependent adult.

This scheme can lead you to a permanent residency in as little as two months. Of the €300k of the real estate investment, €200k must be paid before the application. The property purchased can be of four different types (the properties can be rented out after the process):

- One residential real estate property

- Two residential real estate properties

- One residential real estate property and a commercial space up to 100 m2

- One residential real estate property and an office up to 250 m2

You must consider the following conditions about your investment:

- The value of the properties must be of at least €300k

- Both real estate properties must belong to the same developer

- The purchased properties can be placed in different areas of Cyprus

You must consider that, under this program, you will not be allowed to work in the country. However, you can own a company in the country and earn dividends. To keep the residency, you must go to Cyprus at least once every two years.

For this, you will need to submit the following:

- Title deeds or sale contracts for property or properties purchased in the country

- Proof of payment of at least €200k

- Evidence that you have the minimum annual income required at your disposal

- A letter from a Cypriot bank that you have deposited the minimum amount

- Clean criminal record certificate issued in your country of origin or your last country of residence

- A statement that confirms that you will not work as an employee in the country

- Thus, the required documents that must be submitted to the Civil Registry and the Migration Department are the following:

- Proof of payment of real estate and title deeds

- Bank confirmation of the required deposit

- Original and photocopy of passport

- Source of income statement

- Bank statement and reference letter

- Proof of occupation

- Evidence of residential address

- Evidence of health insurance

- Police clearance certificate

- Two passport-sized photos

- Original or certified copy of marriage and birth certificate (if applicable)

Our experts at Discus Holdings keep track of the real estate market. They will give you an investment portfolio that fits your needs. They do independent studies on real estate projects so you can make a safe investment.

The Discus Holdings legal team will assist you to get the documents you need for your application (the ones we mentioned above) and fill all forms. This is the most vital step because the applicant’s file is the main determinant of a positive response. Discus Holdings’ experts will check the file to verify its quality and that it is complete.

After the client’s file is submitted, the Discus Holdings team will keep up with the process with the Cypriot authorities as they examine the file and its content. Of the total €300k investment, at least €200k must be paid upfront, which means they cannot be refunded if the response if negative. However, the client can sign an agreement where he can condition the acquisition on the positive response of his application. When the client receives a positive response, he will receive a permanent resident’s card and must pay the remaining €100k.

There is also the regular path towards residency in Cyprus, which is cheaper, but also slower. Upon renting a home or purchasing a house or an apartment, you may apply for a permanent residency. The minimum annual foreign secured income must be of at least €10k, and €5k per dependent. The applicant must not maintain employment in Cyprus, and his income must be derived from reputable sources, and, as usual, he must have a squeaky-clean criminal record. The applicant must prove that all financial needs for him and his dependents are covered.

The main benefit of this path is that there is a lower threshold of annual income, there are no investment requirements, and you can rent a house instead of buying one directly. This is a good path for retirees or middle-level businesspeople that will allow them to travel freely to and from Cyprus and is a way of entry to the EU. The main disadvantage is that it takes at least a year until the approval.

The other path towards permanent residency for non-EU citizens is obtaining a temporary residency permit. You will need one if you plan to stay more than 90 days in Cyprus. It is usually granted initially for one year and renewed for two-year periods. It allows you to stay in the country for the duration of the permit. The main restriction is that you cannot leave the country for more than three consecutive months, or the residency would be canceled.

Every applicant must prove that he can lead to a good standard of living in the country without engaging in work activities on the island. That income is €10k for the applicant and €5k per dependent. You can apply for permanent residency after five years of temporary residency. The best way to obtain it is by purchasing a property of at least €300k, but generally, maintaining a solid financial record while you have a temporary residency is the best way to go too.

Also, there are some additional factors to consider about the benefits of Cypriot residency:

- The permanent residency covers your whole family, including your parents, your spouse's parents, and unmarried dependents up to 25-years-old as long as they are students.

- You must consider that becoming a Cypriot resident does not have any tax benefits unless you live in the country for at least 183 days per year. However, this brings plenty of advantages as you will be exempt from taxes on worldwide dividends and interests for 17 years and on gains on disposal of securities forever.

- Obtaining a Cypriot residency gives you and your companies the possibility to offer services across the EU with fewer obstacles, and to transfer funds between EU states, purchase property, transfer goods and invest across the Union with fewer limitations.

- All application documents not originally in English or Greek must be translated.

Who we are

In Mundo, our goal is to protect your legacy, your investments, and your family. Since 1994 we have been aiding high net worth individuals getting second passports to secure their investments, their families, and do business freely.

In these years, we have built an unmatched network of experts to provide the finest services with an unrivaled degree of know-how for our clients. That is why we work with Discus Holdings, which is the best RBI services provider in Cyprus, with operations in dozens of other countries.

They have more than 25 years of experience in second passports and residencies. They offer full transparency, which means you will not have to deal with unwanted surprises like small-letter fees you didn’t expect. For Mundo and all our experts, building trust is the most vital element and is the base on which we build every relationship.

Our experts will offer full support during the process and after the residency or citizenship has been accepted. Discus Holdings and Mundo also give valuable tax and financial advice so that the applicant can safeguard his business and assets during the process.

FAQ – Interview whith Laszlo Kiss, Discus Holdings’ Managing Director

Why is Cyprus attracting so many international investors and high net worth individuals to apply for residency on the island?

Cyprus offers many advantages, such as a warm climate, convenient geographical position, a well-educated workforce, a highly advantageous tax system, and residency via investment programs.

Now, let us get into details. How does the program work? Which are the eligibility criteria for participating? Which are the requirements for family and dependents to be added to the application?

Granting the residency permit is based on the purchase of a property with a minimum value of €300,000+VAT. It has to be a newly built real estate and must be kept throughout the whole residency period. Any under-18 child or dependent over-18 child can be included, and parents of the main applicant can ask for family reunification.

What are the investment options for the residency program?

The most used way to get either residency or citizenship program is an investment of residential property of €300,000.

Is there an appeal process if you are rejected? Do you have the possibility of a total or partial refund?

Yes, there is an appeal process but has not been tried extensively… We advise our client to insist on an option on his purchase agreement to give back the property if the application is refused.

What is the payment process? At what stage does the applicant pay professional and government fees? When does he have to pay the government contributions and make the investment?

The professional fees are usually paid in advance, and the residency application must be accompanied by payment confirmations of at least 300,000 euros of the property investment and the donation.

If a client chooses real estate, what are the options? What should he consider when picking a property?

As always clients should be careful to compare the sale price to the value of the property being offered. As we are not property developers, we always give impartial advice to our clients about the viability of the property project, expected value of the property, or any aspects of the investment.

Must the main applicant disclose his source of funds?

No full disclosure of personal wealth is needed at this moment.

Could you explain in more detail what is the due diligence required regarding funds disclosure? What documents do applicants need to deliver?

Clients must prove the amount for the property investment and the donation arrived in Cyprus, and also that they have been paid the investment and donation through the Cyprus banking system.

What about holding family offices in Cyprus? Is residency a useful way for families to base their businesses in Cyprus?

Due to the good business infrastructure, to English being spoken by nearly everyone, excellent weather, and most importantly by the very advantageous personal and corporate income tax rates Cyprus is one of the best places to do business in Europe.

What services Discus Holdings provide for interested investors? What differentiates it from other service providers?

Discus provides full professional residency and citizenship services for its international clients. The quality and expertise of our services are based on our experience of 28 years in international wealth structuring.

Does Discus Holdings help their clients in choosing these investments? How?

For choosing the property we can directly work with us, while the provision of specific investment advice is a licensable activity in the EU, so for specific financial investments, we are working for licensed investment and tax advisors.

Please, tell us about your Cyprus team. What has been your success rate in applications for the RBI program?

We have been operating in Cyprus through our own office since 2006 and have a 100% success rate for applications. I think it is due to the fact that our Due diligence checks are very robust and strict. We simply want to avoid controversial or bad clients…

One last message for Mundo’s network of investor

Everyone needs a Plan B…

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Having structures abroad, like companies or bank accounts, can significantly boost your projects, br...

The Caribbean is entering a decisive stage of transformation. Regional governments are introducing u...

We think that the most challenging part of choosing a CBI is considering the minimum investment, the...

The world map is covered with shades of blue, yet only a few places make time stand still. Among the...

The waters of the Caribbean and the sands of the Persian Gulf may seem like very different worlds, y...

By constantly finding new opportunities, we can help readers achieve their goals and find what they'...

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)