Private Equity Investments Opportunities

.jpg)

You can also enjoy access to private equity investment opportunities that are usually reserved to institutional investors.

Among those private equity investment opportunities are two that are particularly popular with our clients because of the combination of features and return on investment they offer. On the one hand, we are talking about our Late Stage Venture Capital Fund and, on the other hand, about Pre-IPO stocks.

Let's take a closer look at the most relevant information about these two investment options.

1. Late Stage Venture Capital Fund

This investment vehicle is part of our private equity options. These options are still highly recommended for any investor looking for superior returns as they are not particularly risky options compared to similar vehicles.

The characteristics of the Late Stage Venture Capital Fund are as follows:

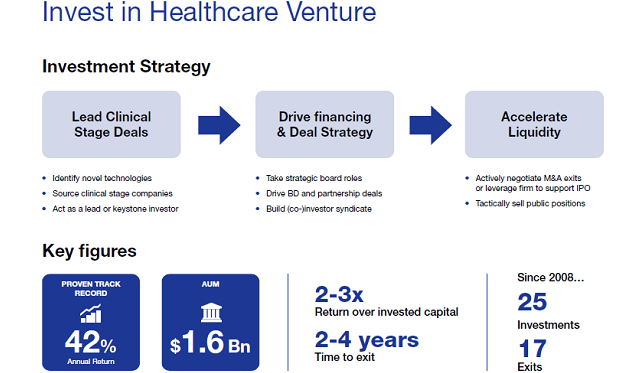

Global Healthcare Specialist

This fund is managed by a team with the best track record in the world when it comes to Biotech and medtech private equities. In addition, this fund has successfully brought more than 100 private companies towards IPOs in the Healthcare sector in the U.S. market, as well as in Europe and Asia.

Consistently Strong Returns

This asset manager currently manages assets totaling $1.6 billion and has a target return of 2 to 3 times the amount of capital invested over a period of 2 to 4 years.

The Late Stage Venture Capital Fund also has other indicators such as:

- It has successfully deployed four venture funds.

- 25 investments in private companies and 17 exits.

- 2.3 times net multiple and 42% net IRR on exits.

- Fund & create value in companies with high M&A and exit potential.

- Investment via capital calls

- Luxembourg Limited Partnership

2. Pre-IPO Stocks

This private equity investment vehicle allows you to take advantage of market inefficiencies to generate a very interesting return on investment by investing in privately held technology companies a few years before they become public.

The main strategy of these private equity investments is based on two fundamental aspects:

- Invest in the latest stage of private growth companies expected to go public in the coming years.

- one of the highest returning institutionally investable asset classes over the last five years.

These investment opportunities are hugely profitable because it allows you to invest at a key moment for companies, which is just before their technology reaches a mature level of adoption and development. This is precisely the phase of greatest growth and the time when you can generate the highest return on your investment.

These types of private equity opportunities are often the perfect complement to a portfolio designed for clients with a conservative investment profile, as they offer the possibility of maximizing the return on your money without exposing you to considerable risk.

Combining these vehicles with our core funds is a strategy that allows you to achieve the maximum level of diversification in your investment portfolio.

If you would like to know more about these investment alternatives, contact our team of experts now.

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Between the Pyrenees, where mountain passes link France and Spain, lies Andorra principality one of ...

Having structures abroad, like companies or bank accounts, can significantly boost your projects, br...

The Caribbean is entering a decisive stage of transformation. Regional governments are introducing u...

We think that the most challenging part of choosing a CBI is considering the minimum investment, the...

The world map is covered with shades of blue, yet only a few places make time stand still. Among the...

The waters of the Caribbean and the sands of the Persian Gulf may seem like very different worlds, y...