Is Singapore a city, an island, or a country? Well, it is a modern metropolis, that mixes all these categories. Singapore is both an island and a country, but perhaps its best description is that of a city-state.

But of course, even though it is physically small, it is also an economic giant. It is made up of a diamond-shaped Singapore Island and some 60 small islets; the main island occupies all but about 18 square miles of its combined area.

If you are new to Singapore, you are probably wondering how this small city-state in Southeast Asia with a total land area measuring only 721.5 square kilometers, and one of the youngest nations in the world became one of its most successful. The answer is that this "Asian Tiger" is a unique place that allows you to escape from the world's troubles and maybe connect to bigger opportunities and business.

Political stability: 10

If you are looking for synonyms for a free economy, Singapore comes to mind.

This small island-city of just 5.6 million inhabitants has deep importance for global finances and has the second-highest GDP per capita with the largest amount of millionaires per capita on the planet.

Why the success? The freest economy in the world, per the Index of Economic Freedom. This has led Singapore to have a well-developed banking system. With Hong Kong’s instability and higher taxes in Switzerland, many are going for Singapore as their safe banking destination.

So, you have a robust judiciary and regulatory compliance, a free economy led by a pro-business government, and an optimized and straightforward tax system.

That's the key to Singapore's success.

Why should Singapore be your next banking destination?

Singapore is the best example of the expression "extreme makeover." It went from being a poor state to the freest economy in the world and the fourth most prosperous country worldwide.

Now, Singapore is one of the world’s economic engines, and the next place you should look to establish a corporate structure. Whether it is for holding purposes or for a trading business, Singapore should be at the top of your list.

Why?

- The highest personal security index in Asia.

- The freest economy on the planet, according to the Index of Economic Freedom.

- English is the official language and it is used for business and administrative matters, which eases doing business.

- There is a completely free flow of foreign currency

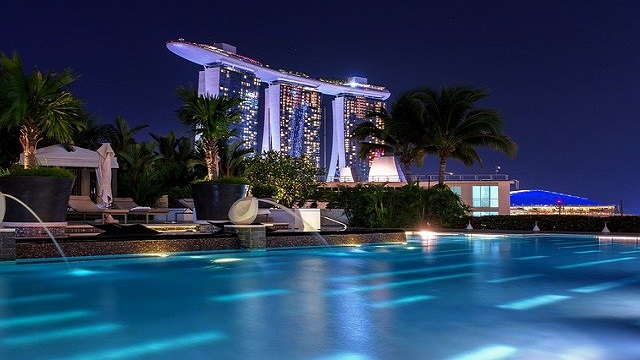

You can probably count with one hand the places where you can live better than in Singapore. This high-tech city-state has one of the best life qualities on the planet and is a top financial destination. Living in Singapore is only for the most demanding Mundo readers who are seeking to establish their family office in one of the top destinations of the world while investing in one of the financial Meccas of the Far-East.

Singapore has almost everything a high net worth individual needs to live there, from all the comfort and luxury a place can offer to low taxes and opportunities to thrive economically.

Why should you apply for the residency by investment in Singapore?

-Low taxes: Singapore has a territorial tax system, which means you will only pay taxes over your Singapore-remitted income and if you set your tax residency in Singapore, no other country will be able to claim taxes over your worldwide income. Plus, Singapore is a low-tax jurisdiction with a top income tax of 22%, which is half of the top income tax of many OECD nations.

If you have read the predictions of our expert team in the COVID-19 report you will see that any reasonable family office should start planning its escape from those jurisdictions that have shown an inability to deal with the crisis.

Sadly, much of Europe and the US fall under these categories. They will likely face increasing taxation, financial meltdown, and social unrest. You need a family office and these territories do not have many good options.

But Singapore is among the best.

Certainly, it is not for everyone, but a Singapore family office will guarantee your intergenerational wealth. Your child and grandchild will not have to worry about anything.

Why should you choose Singapore? In a nutshell:

1. Singapore does not tax worldwide income. Thus, no country will be able to claim taxes over your worldwide income while you live in a fully whitelisted jurisdiction. Plus, Singapore has a flat 17% corporate tax rate with plenty of tax incentives and a top 22% personal income tax rate, which is about half of the top income tax rate in most OECD countries.

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Very few programs are as friendly to retirees as the one we're featuring in this article. With an ea...

Everyone who sees property purchase as an investment strategy should consider pre-construction Panam...

In Panama, the real estate market is significant because of its convenient costs and the permanent r...

When discussing territorial taxation, Panama comes up. Nevertheless, here and in any country, it's i...

Many embark on the journey that is going from Panama residency to citizenship, and this is quite an ...

When we assess what residency to apply for, a comparison always helps. Today, we'll compare Panama v...

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)