New Zealand (NZ) foreign trusts as well as pre-migration trusts are popular with overseas investors. New Zealand has a well-established trust industry. Despite the worldwide initiative against trusts as vehicles of choice, New Zealand continues to be sought after as a jurisdiction of choice due to its white standing with OECD.

What Is a NZ Trust?

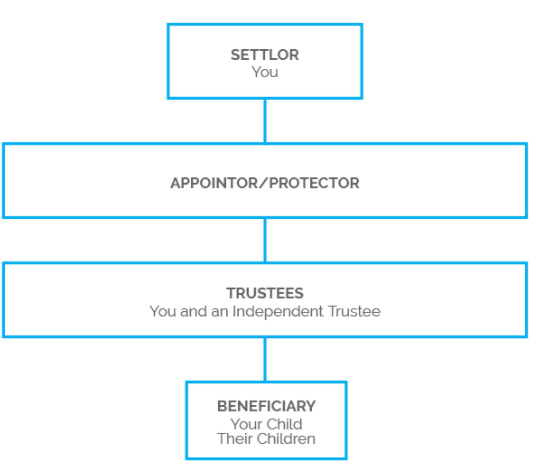

Trust definition is usually worded as a fiduciary relationship where the settlor (founder of the trust) transfers assets to the trustee, who holds or manages those assets for the benefit of third persons (beneficiaries). In effect, the legal and beneficial ownerships are split. Legal ownership is vested in the trustee, yet the beneficial ownership is that of the beneficiaries.

Recent changes to the legislation amended the period of the trust to 125 years. Irrespective of the trust period, the trust can be terminated earlier either by winding up or via resettlement to another trust or multiple trusts. When resettlement takes place, one must be careful that the trust period is not breached.

New Zealand trust can be structured in different ways. The minimum number of trustees is two individuals or one corporate trustee, often referred to as Private Trust Company (PTC).

Settlor

The settlor is the one, on whose instruction a trust is established by settling assets onto the trust. The settlor, in effect, loses control over the assets transferred to the trust since the legal ownership of those assets is vested in the trustee. The New Zealand trustee services imply management of the trust assets in favour of the beneficiaries. The trustee acts in line with the provisions of the Trust Deed which is supplemented by the settlor’s Memorandum of Wishes.

Memorandum of Wishes is a document separate from that of the Trust Deed which outlines the settlor’s wishes as to how the assets must be dealt with, how to deal with beneficiaries in the event of conflict and whether or not certain beneficiaries may be preferred. Memorandum of Wishes may also impose restrictions on disclosure of information to the beneficiaries if valid reasons arise. Memorandum of Wishes is a living document and it can be amended as required.

Protector

The use of a protector (an attorney, a professional, or a family member) aims at creating a means of protection and security for any problems that may emerge in connection with the assets under management and as a way to counterbalance the powers of a trustee. One must however give due consideration to the ability of a protector being replaced in the event that circumstances change and the initial protector is no longer desirable.

Trustee

A trustee is a person holding the legal title to the assets and is responsible for the general management. The trustee’s powers must be exercised in compliance with the Trust Deed, whilst keeping in mind the settlor’s Memorandum of Wishes. Trustee must conduct his trustee duties in the best interests of the beneficiaries.

Beneficiaries

The beneficiaries are individuals who have the right to benefit from the trust assets held by the trust. Whilst the settlor can be indicated as a sole beneficiary, the Settlor tends to be one of several other beneficiaries. Beneficiaries are generally close family members such as children, parents, siblings or even other trusts that have been established for the benefit of close family members. Beneficiaries can be divided into different classes such as primary, secondary and so on with different beneficiary distribution rights attached to each class.

The Statutes Regulating NZ Trusts

New Zealand has a long-established trust industry. Trusts are widely used in NZ. Most well-off individuals have more than one trust.

Trusts in NZ were governed until recently by Trustee Act dated 1956, which is based to a large extent on England’s 1925 Trustee Act. Recent NZ trust law changes resulted in the NZ Trusts Act 2019, which came into effect on January 30, 2021. The purpose of the new Act is to modernize the law governing trusts for the first time in more than 60 years.

Whilst the Act does not significantly change the underlying trust principles, it provides for more clarity to beneficiaries in terms of their rights. It also sets out the respective trustee’s duties.

Types of Trusts and Their Purposes

When speaking about trusts, it’s necessary to point out that the vast majority of trusts in NZ, whether family or business trusts, are discretionary trusts.

The term “discretionary” refers to the discretionary powers that the trustee has. Discretionary powers are generally in relation to the beneficiary distribution i.e. deciding which trust beneficiary receives a payment from the trust income or capital and the frequency of such payments. The settlor can, to a certain extent, limit those powers by carefully inserting provisions in the Trust Deed.

Family Trust

What is a family trust? The definition of a family trust is quite simple: it is a foundation providing for almost every aspect of asset protection as well as estate planning. Setting up a family trust one aims to protect family’s lifestyle and retirement assets and allow for any changes that may occur in life. Family trusts can have individual trustees or a corporate trustee. There is no prescribed requirement for the type of a trustee that a family trust has other than the minimum number of trustees must be met. Within the family trusts we can also define sub-types:

a) Mirror or Parallel Trusts

Mirror trusts consist of two trusts: one for each partner/ spouse. These trusts are losing their popularity as they tend to be restrictive, if not well thought out. This type of a trust should be considered by those who have disproportionate values in the assets they hold and have, for instance, children from previous marriages. When forming new relationships, the partners often wish to somehow separate their assets within a blended family scenario and a constitution of two parallel trusts is always a good option.

b) Inheritance Trusts

It’s another sub-type of a family trust which is generally set up by parents for the benefit of their child. It provides certainty and security that the assets left to the child will be protected for the next generation no matter what the future holds.

Business Trust

The goal of creating a business trust speaks for itself. It is set up to separate the riskier business assets from the safer family assets. It is not uncommon for a family trust to be the beneficiary of a business trust as it provides for seamless transfer of wealth created by the business trust to the family trust and its beneficiaries.

Charitable Trust

Charitable trusts play an important role as a philanthropic giving mechanism. It is specifically designed for charitable purposes: relief of poverty, education or religion advancement, or any other matter beneficial to the community.

Benefits of a Trust in New Zealand

1) Stability and good reputation of the country

The very first benefit is the country itself that is viewed as an idyllic paradise farm by the rest of the world. New Zealand has a stable economic, legal, political and business environment.

It is a well-respected member of the OECD and FATF. New Zealand ensures a stable, safe and reliable arena for doing business.

Not being black listed as a “tax haven” country, New Zealand offers tax advantages for foreign trusts. Foreign trusts are the trusts with a foreign resident settlor, where the assets and beneficiaries of the trust are based outside of NZ. Establishing a NZ foreign trust may be beneficial from NZ tax perspective: it does not preclude the source country where the assets are situated imposing income or capital gains tax.

New Zealand has concluded Double Tax Agreements with 40 jurisdictions.

2) Asset protection

• Protection against creditors

A usual situation would be if the parents have personal liabilities (often related to their business interests), and they wish to protect their family from such liabilities in the event they are unable to meet them. In most instances a trust can be a useful vehicle in this regard, although some transactions could be set aside.

• Protection against property claims

If the parents’ assets, for instance, are owned by a trust, their children can continue receiving the benefit of those assets without getting the assets mixed up within their personal property, and therefore the assets cannot be subject to claims by the children’s partners.

If the assets are transferred into a family trust prior to entering into a relationship, the assets in the trust are less likely to be subject to a relationship property claim if the relationship terminates, provided that the assets in the trust are classified as a separate property. There are circumstances when the trust property can become the relationship property, however with careful planning these situations can be avoided.

• Protecting property from or for beneficiaries

Parents may not want to give their assets to their children during their life or on death if they have concerns about their children’s ability to manage financial affairs. By giving assets to a family trust, the trust can provide a child with income and/or capital to meet their life style requirements.

• Protecting assets for future generations from possible tax law changes

Family trusts may ensure protection against various forms of wealth tax that may be introduced in future, such as death duties or inheritance tax. Whilst some countries have introduced legislation which makes the trust distribute its assets every so often such as UK and Canada, NZ has not adopted such rules yet.

3) Foreign participation

NZ foreign trusts cater for complete foreign participation: the settlor and the beneficiaries can all be foreigners with the assets located outside of New Zealand.

A NZ foreign trust requires that there should be one resident trustee, either an individual or a company.

4) Taxation of trusts

New Zealand trust taxation is quite favourable. NZ foreign trusts do not pay New Zealand taxes on income earned outside the country and that income is not subject to taxing in New Zealand when distributed to a non-resident beneficiary of the trust, unless it is caught under Foreign Hybrid Rules, which more often than not relate to financial arrangements. Knowing the customer and the types of assets is imperative to ensure that the foreign trust will in fact enjoy the tax exemption.

Foreign resident beneficiaries will NOT be subject to the following taxes in New Zealand:

- income tax or capital gains tax (when a trustee may make distributions from a foreign sourced income or capital gain by a trust established in New Zealand)

- inheritance or wealth tax

- gift tax or stamp duty

- GST or equivalent forms of indirect taxation (when creating or making a transfer of assets to the trust)

Note, this does not mean that the trust will end up paying no taxes. Generally the trust’s income or capital gain is likely to be taxed in the country of source.

5) Confidentiality

There are no public NZ trust registers, so no information regarding trusts is made public, although the Trust Act 2019 requires for basic trust information to be provided to the beneficiaries.

New Zealand foreign trusts are required to be registered with the Inland Revenue Department (IRD) and must provide a copy of a trust deed, contacts and identification details of settlors, trustees and holders of the power to appoint and remove trustees to the IRD.

Most recently, further regulations have been made whereby details of all settlements, trust distribution to beneficiaries and financial statements will need to be submitted to the IRD. This is no different from regulations in other foreign jurisdictions.

6) Flexibility of the structure and controls

The number of participants in a trust can be quite big. Whilst there can be several settlors, generally there tends to be one or two main settlors in relation to a particular trust. The group of beneficiaries can be wide, however these can be divided into different classes giving them differing participating rights.

Whilst an individual can set out in their will who is to receive their property after their death, wills can be challenged through courts. If a person transfers their assets to the trust before they die, then those assets will not, as a rule, be covered by their will or any challenge to that will, unless the assets were transferred to the trust under the will.

7) Fast formation

A trust deed can be made up quickly and no prior government registration is required.

Conclusion

What differentiates a NZ trust from another trust?

New Zealand has a good international reputation and has a white list status with the OECD.

New Zealand trust does not have a typical “tax haven” stigma attached to it. Actually, it’s one of the best jurisdictions to establish a trust in.

Furthermore, the legal protection is afforded by robust Trusts Act supported by a 600-year English jurisprudence.

The protection that the trust assets can enjoy is secured through separation of legal vs. beneficial ownership. If planned carefully, it is not easy for the settlor’s creditors, spouses and other claimants to raise claims against the trust assets. There is therefore a possibility that the wealth could grow independently of the settlor’s credit worthiness. Although governments around the world will set aside arrangements, whose purpose is criminal activity, etc.

One may ask: and how do you control the trustee? The answer is a twofold.

So, when making up your mind to create a (family) trust, think clearly of its purpose, type, and the trust membership. It’s not always that easy as many things need to be considered.

If you need any assistance or professional advice in this matter, we are here to assist you.

Please Contact us

$170,000

$1,400,000

$350,000

$395,000

$165,000

Интерес к покупке жилья за границей давно вышел за рамки личного комфорта. Всё чаще недвижимость рас...

Инвестиционная программа всегда включает официальную процедуру рассмотрения заявки, по результатам к...

Решение о получении нового правового статуса редко принимается в одиночку. В большинстве случаев за ...

Современная банковская система все реже опирается на формальные признаки и все чаще анализирует сово...

Рынок жилья за рубежом всегда кажется сложным, пока вы не разложите его на понятные шаги. Панама при...

Когда человек начинает думать о сохранности имущества, разговор почти всегда выходит за рамки «где х...

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)

.webp.small.WebP)