How to Invest in Fixed Income Bonds

Have you ever wondered how you can invest in order to constantly grow your wealth? If the answer to this question is yes, this information is of interest to you. An investor is constantly on the lookout for attractive destinations to direct his funds and capital to in order to generate profits, so businesses such as investment funds, bonds, property rental, and many, many others take shape.

In this opportunity, we will introduce you to an opportunity of great renown and with an enormous potential to generate profits and constant returns. We are referring to the "Fixed Income Bond", a UK corporate bond that makes interest payments to investors. These payments are made in the form of fixed annuities set at the time the investment is made.

Important Note: Mundo has recieved news that the product described in this article is not available. Mundo doesn't recommend this type of investment. If you want to know what investments are available, contact our experts.

Fixed income bonds constitute a loan or loans received by a business or company. These funds will be reinvested and will generate subsequent profits for the company and the investors or lenders. At the time the investment is made, the interest rate at which payments will be made is established, as well as the duration of the bond. At the end of its execution, the borrowed company must have repaid the original loan in full.

How Do Fixed Income Bonds Work?

Fixed-Rate Bonds are available with different terms. In general, the longer the term, the higher is the interest rate. Most Fixed Rate Bonds require a minimum deposit to open the account. Unlike many other savings accounts, you are usually only allowed to pay in once, which is when you open the account. Providers of Fixed Rate Bonds may give you the option to have earned interest paid out either monthly or yearly.

The Fixed Income Bond is a mid-to-high risk investment with security in place to mitigate risk, which means that your funds and investment will always be protected. It offers an active approach with a global reach, drawing on a pool of specialized investment talent, coupled with a strong performance culture and solid risk management.

What Are the Main Aspects and Benefits of the Fixed Income Bond?

The Fixed Income Bond was created to generate great and unique opportunities for high-caliber investors. Its main objective is to deliver high returns in short periods of time and with a fixed rate. Let’s know more about it:

- Fixed Income Bond offers its investors a coupon rate of 12% per annum (paid quarterly).

- It has a 24-month length, which can be renewed for up to 5 years if the investor so desires.

- It requires a minimal investment of $125.000. And yes, it may be issuable and purchased in US Dollars.

- The investors receive a guarantee from wealth manager to indemnify any loss incurred by the issuer and its bondholders.

- This bond explores great opportunities thanks to its exclusive network of selected brokers and Tier 1 banks.

- Fixed Income Bond charges a one-off administration fee of 2% for the two-year term.

- It generates great benefits that not only restore the initial amount of the investment, but adds significant percentages of profit.

- It is listed on the Frankfurt Stock Exchange.

- Fixed income bonds carry lower risks than stocks and shares investments.

- With this bond, you will be able to preserve your capital.

- By investing in the Fixed Income Bond, you will have a continuous source of income, which will always be advantageous.

How to Know if the Investment Is Fully Secured?

When investing, no matter what type of business it is, the investor's main concern is to know if his funds are safe, and moreover, how he can recover his investment if for whatever reason, the company or business in which he invested does not generate the expected profits, or in the worst case, goes bankrupt.

The Fixed Income Bond is aware of these concerns, which is why it is insured and has sufficient funds to offset any potential losses or underperformance.

This bond features a Collateral Manager, which is responsible, through security trusts, for indemnifying any losses arising from the bond itself. The contractual agreement states that as guarantor and principal obligor, the Manager will at all times cover the ultimate balance owing to the Bondholders and indemnify the Security Trustee acting on behalf of the Bondholders against the unlikely event that any losses, costs, claims, liabilities, damages, demands, and expenses are suffered or incurred.

In conclusion, the Fixed Income Bond is fully capable of mitigating any flaws or underperformance that could jeopardize investors' investments and capital through the mechanisms outlined above, which, it is important to note, are designed to be executed for the benefit of bondholders.

- Security Trustee

- Registered Debenture

- Guarantee & Indemnity

How to Invest in the Fixed Income Bond?

To invest in this bond, there are no major requirements. The main focus to pay attention to is the monetary focus, outlined in the economic power of the investors. This bond, as we have already mentioned, is designed for companies and investors with high net worth and sophisticated investors.

This bond has certain qualities that enhance its attractiveness to investors, one of which is that it provides the opportunity to invest in a variety of powerful currencies. It is not limited to the local Pound Sterling, but thanks to the demand coming from different investment funds and other companies in Europe, South America, the Middle East, and Africa, the Euro and the Dollar can also be used to carry out your investment.

You will not have to resort to exhausting and long processes of exchange or transfer from one currency to another to invest, but, if you have one of these 3 currencies, you will be able to do it without any inconvenience.

Returning to the subject of how to invest in this bond, as an investor, you will have to make a minimum investment of:

- GBP: 100.000

- EUR: 100.000

- USD: 125.000

Where Does the Capital Go When Invested in the Fixed Income Bond?

Once you become a bondholder of the Fixed Income Bond, alongside the mentioned Collateral Manager, you take advantage of privileged access to trade programs that yield a high rate of returns, with great profits by selling financial instruments like shares, stocks, currency, and other bonds.

In other words, once you get into the bond, it starts to operate by making trades with financial instruments. These instruments have value and legal recognition. To make it simple, the investor, by lending money, has a financial asset, while the issuer of the bond (in this particular case) has to account for the bonds as a financial liability.

The expert has access to private trade programs that operate on an arbitrage basis whereby financial instruments are simultaneously bought and sold for a predetermined price, it is the margin between the buy/sell price where they are able to obtain the profit.

The financial instruments traded by the bond could be properties, debt contracts, company shares, investment funds, exchange-traded funds, and lots more. What the bond basically does is to trade these assets looking for the profits given by its value’s variation; that’s where the gain is, and as an investor, you progressively receive the benefits from the trade, until the bond gets to its maturity.

So, as you can see, the investment process and subsequent profits and benefits are obtained from an elaborate trading system, safe and totally legal. This process of buying/selling and trading is constant throughout the life of the Fixed Income Bond. Please contact us to learn more about this great investment program.

Is the Fixed Income Bond a Winner?

The answer is a big YES!! It’s easy to say, but more than that, we want to show you that investing in this long-term bond will generate you nothing but profits. Instead of having your savings stored and not growing inside a bank account, we would like to invite you to access a type of investment with a proven reputation and important benefits. And because we want you to be sure to trust us, we present the following:

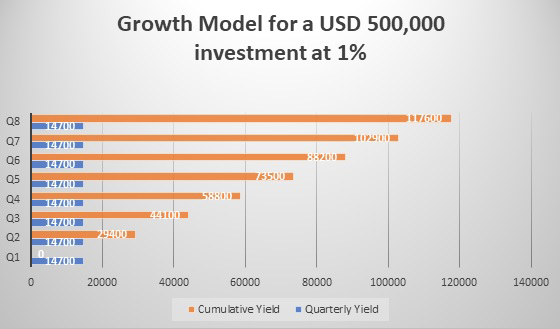

By allocating an investment of at least USD 500,000, after the initial 2% fee, and an interest rate of 12% per annum; this is how your profits will look like:

At the end of the 24-month term, bondholders will receive back 98% of their investment. Therefore, the total returned to the investor is: USD 607.600

We can see then that investing in the Fixed Income Bond is a very good opportunity for premium investors and in general, for individuals and companies looking to generate important returns from a stable, secure, and committed model with their clients.

It is important to know that in order to reach the maximum level of productivity of this investment fund, you should not withdraw your money before it reaches maturity. An investor may redeem their bond by giving three months’ written notice after 12 months. There is a 2% early redemption fee. The minimum redemption amount is £50,000 and the investor must retain a minimum of £50,000 within the bond until the maturity date.

With Fixed Income Bond you can have the 5-year route to permanent residency in the UK:

a minimum £2m investment will allow you:

- initial application: 3 years 4 months granted

- application extension: 2 years granted

- indefinite leave to remain application (permanent residency): 5 years

- citizenship application: 12 months after achieving permanent residency

Questions and Answers

1. What type of investment is this?

Fixed Income Bond is a UK corporate bond which makes fixed interest payments to investors.

2. What is a corporate bond?

A corporate bond is a loan to a company, which returns to the investor a fixed rate of interest for the term of the bond.

3. What are the terms of the bond?

Fixed Income Bond pays a fixed coupon of 1% per month, paid quarterly in arrears to the investor. The bond has a two-year fixed term, after which a roll-over option is available should the investor wish to continue.

4. What are the charges?

Fixed Income Bond charges a one-off administration fee of 2% for the two-year term.

5. How is the bond issuer able to offer such a high return?

Fixed Income Bond has streamlined operating overheads and reduced risk by working in partnership with the wealth manager who acts as the ‘Collateral Manager’. The wealth manager utilizes its worldwide network of Tier1 trading platforms to invest in trading strategies which generate an immediate return.

6. Is fixed income bond reguladet and listed?

Fixed Income Bond was listed on Frankfurt Börse as of 16 April 2020.

7. Who are the bond registrars and what is their role?

Avenir Registrars (Company No. 09009850) maintains an up to date register of securities purchased from Fixed Income Bond, assuring bondholders that there is a secured record and receipt of their investment.

8. What happens to my money when trades?

Funds are held in the wealth manager’s corporate bank account and are blocked on a non-recourse basis in favour of the trade. When the trade is completed the block is released.

9. How do i get paid my coupon?

Coupon payments will be made quarterly by Fixed Income Bond to the bank account details provided by the client.

10. What happens if i need my money back before the bonds maturity date?

An investor may redeem their bond by giving three months written notice after 12 months. There is a 2% early redemption fee. The minimum redemption amount is £50,000 and the investor must retain a minimum of £50,000 within the bond until the maturity date.

11. Are the bonds transferable?

Yes , they are transferable.

What can we do for you?

If you are a high-net-worth investor and are interested in investing in the Fixed Income Bond, contact us today and our experts will help answer any questions you may have, as well as advise you on the best course of action for the realization of your investment.

This can be the gateway to great profits and gains, which you can then reinvest or use as you wish. Do not miss this opportunity. We are waiting for you!

.png.small.WebP)

.webp.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

When discussing territorial taxation, Panama comes up. Nevertheless, here and in any country, it's i...

Many embark on the journey that is going from Panama residency to citizenship, and this is quite an ...

When we assess what residency to apply for, a comparison always helps. Today, we'll compare Panama v...

More and more people are deciding to obtain dual citizenship, especially Americans, Canadians, Weste...

Given the increased interest in how to get São Tomé citizenship, especially from Canadian and U.S. c...

When it comes to Panama residency, banking plays an important role, whether it is for proving solven...