Best AML System Solution for Banking Institutions

.jpg.WebP)

In today's globalised financial system there are many advantages for the world economy, however, there are also problems that over the years different governments and financial institutions have tried to eradicate.

One of these problems is money laundering and bank fraud, which to this day remains one of the most common problems within the financial world of our global economic system, as there are many ways to commit these crimes.

For this problem, several efforts have been made from the legislation of many countries and the sophistication of the technological systems of the financial institutions in order to mitigate this type of crime, but as time goes by, new measures must be implemented.

New technologies in this regard are something that financial institutions, especially banks, have to take advantage of.

However, MUNDO’s partner has the top technology in this regard which has the following features:

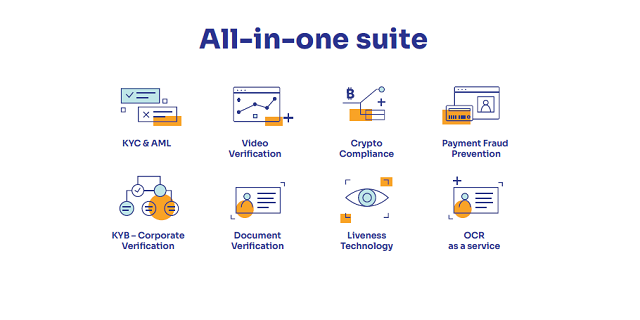

● KYC and AML technology

● Video verification

● Crypto compliance

● Payment fraud prevention

● KYB - Corporate verification

● Document verification

● Liveness technology

● OCR as a service

These features have made this anti-money laundering and banking security system one of the most sophisticated in the global market, having world-class renowned clients. Clients such as Moonpay, Hyundai, TransferGo, among others, are just a few of them.

The AML System Functional

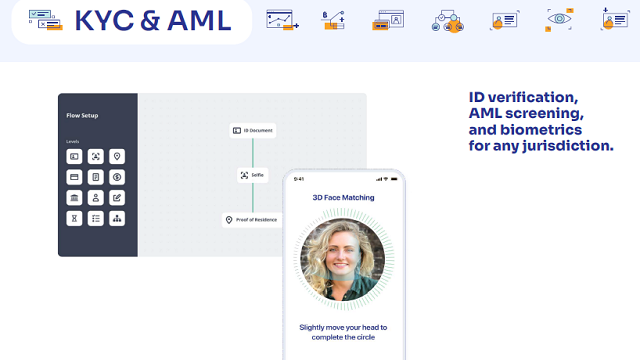

1. KYC and AML Technology

This function is available in more than 220 jurisdictions worldwide, which makes it quite comprehensive. The process is generally 95% automated, which means that identity verification does not take so long with a 93% pass rate.

KYC system shares this information with a network of partners after only verifying a customer once, entering it into a global database.

As for AML (Anti-Money Laundering), this technology has data screening and permanent monitoring functions on lists of politically exposed people (PEPs), sanctioned people, watch lists and others that allow a comprehensive control over potential criminals in this regard.

Also, there is a complete system of analysis of metadata and security checks by using a graphical detection system which enables this technology to carry out such a control as stated before.

2. Video Verification

For this feature, specialized agents in this area are assigned to take care of this while the automated verification system performs the checks on the documents.

The specialized verification agents must comply with the AMLD (Anti-Money Laundering Directive) in each country where these services are offered. Also, this operation is conducted with people-friendly workflows and flexible time scheduling, and support for almost every device.

3. Crypto Compliance

The world of cryptocurrencies has not lagged behind in this aspect; in fact, their decentralized nature means that there is less control over the transactions carried out with them. However, among the solutions offered by this sophisticated platform is the monitoring of cryptocurrency transactions.

The services include detailed reports that are subsequently shared with banking and regulatory institutions to monitor suspicious transactions, as well as offering an in-depth investigation into the source and destination of funds traded.

In addition, the system relies on risk scores based on AML policies and suspicious activity alerts on each individual involved.

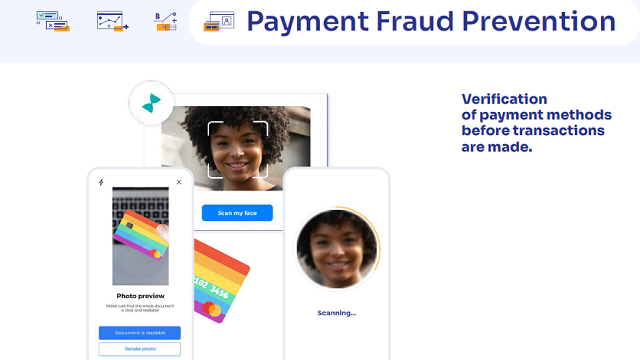

4. Payment Fraud Prevention

The mechanism is aimed at performing a customer authentication process by detecting the activity and cross-referencing the data supplied to the customer's KYC system with the transaction information. All of this is made to make sure that the account holder is the only one able to make financial transactions within the account in a secure manner.

Plus, practices such as click fraud, suspicious IP addresses and VPN services will trigger the system's anti-fraud mechanisms to prevent any account theft.

5. KYB

KYB function (Know Your Business), refers to a higher level of verification for corporations registered with financial institutions that have this sophisticated system, which is supported by the qualified legal team.

The verification required by this function covers all aspects of each country's legislation, using governmental records. At the same time, there is also at place a monitoring of corporate documents to understand the structure of the company while analyzing each individual involved with AML technology.

The verification process is carried out by the automated tools that design specific questionnaires to avoid having to send multiple emails with the required data, as well as a real-time legal support service.

6. Document Verification

The functions of this system include the verification of a wide range of documents, from credit cards to proof of residence. In fact, the documents accepted for the verification process are set out within the platforms, and the process takes only minutes.

7. Liveness Technology

This mechanism was designed by us to offer a proprietary facial biometrics service for quick access and continuous checks. The automation of the product itself results in a pass rate of over 90%. However, it also has sophisticated anti-fraud software that detects video projections, Hollywood masks and any other type of scamming.

It also has a complex security system to protect customers from individuals who specialize in reverse engineering and other account invasion practices.

8. OCR as a Service

OCR system stands for scanning images to extract the text they contain. For this system, the OCR service can be used in mobile phone and web service.

This function usually has a fairly accurate mechanism for recognizing faked or edited documents.

Why Financial Institutions Need This System?

The strength of a banking institution should be its security system. This is what gives customers confidence. However, the security offered should not only be a bank's strength, but also its AML policies.

In order to do so, they must adapt to the evolution of technology and the individuals who carry out illicit activities within these institutions, which is why a verification and security system such as this one should be mandatory within your platforms.

With our partner’s sophisticated anti-fraud system, your financial institution can have all the relevant security protocols in place regardless of country legislation, and in the most up-to-date manner possible and you will save lots of costs as it is all-in-one suite solution that any financial institution would dream of.

Why MUNDO’s Partner?

We at MUNDO have become representatives of our partner that provides the best of all currently existing AML systems.

Our partner’s clients from all over the world support their policies, working methods and features because:

● All the checks and security mechanism at a simple touch

● Proven tools for each step and stage of the ecosystem

● Covering 220+ countries

● 24/7 legal advice and technical support

● The most sophisticated anti-fraud mechanism for the most comprehensive security system

● Usage of metadata to analyze how your team works to prevent fraud attempts

Process to Onboard Your Bank

MUNDO’s partner counts on a fast process to establish a proper partnership with financial institutions, as follows:

1. Discovery call

2. Demo of the product

3. Discuss the pricing

4. Contract and payment

5. Setting up technically and legally with the provider’s team

6. After-installation support

At Mundo we can provide you with in-depth guidance on banking security issues and AML policies. To find out detailed information or prices you can CONTACT US or talk directly to our partner!

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

By constantly finding new opportunities, we can help readers achieve their goals and find what they'...

When people obtain new citizenship, they often think about documents, taxes, or minimum stay require...

Have you ever dreamed of becoming part of history? In Panama, such a dream has an address — Casco Vi...

Panama is a place where the sun rises early and everything happens at the right moment. Every step h...

Understanding what a beneficiary and the concept of an ultimate beneficial owner is is essential for...

At Mundo, we are constantly searching for the latest news and changes in the CBI industry. In the pa...