One of the strongest features of Hungary and one of the best opportunities for international investors is the creation of a Hungarian trust.

This country offers us a great asset protection tool with excellent options for tax optimization such as:

- A secure legal environment (foreign rulings are subject to a few bilateral treaties).

- Low tax on the assets

- Reputable jurisdiction

- Flexibility

- Option to establish other asset protection structures.

Hungary enforces foreign rulings subject to bilateral treaties of which there are only a few, which means that, if you are a US citizen, for example, and your trust is set up in

Hungary, creditors or ex-spouses will have a very hard time reaching your assets . If they are brave enough to go after your property, then they will have to do it through the Hungarian legal system and wish them good luck, because local law is extremely protective of trusts. It is difficult, even in Hungary, to set a trust apart.

In order for this to happen the claimant will have to prove beyond reasonable doubt that he had a legal claim against the settlor in Hungary before the trust was created, that the settlor was acting in bad faith while establishing the trust and, if this is successfully proven, in order to penetrate the trust structure the claimant has to prove that the settlor can´t satisfy the claim using other sources outside the trust ownership.

The Hungarian trust also offers unique tax advantages that will surely surprise you. We are talking about the lowest income tax rate in the EU and the second lowest among the OECD countries. The trust’s assets are considered a tax resident entity, therefore are subject to a flat rate of an exceptionally low 9% a year and local taxes from 0% to 2%.

Mundo believes that Eastern Europe has some of the best business developing and asset protection opportunities, and in this section, we discuss the details of a Hungarian trust.

The Hungarian trust in a nutshell

The best introduction to this topic is to present the main characteristics of a Hungarian trust:

- The trust arrangement must be in writing

- The trustee cannot be the sole beneficiary

- The trust assets must be separated from the trustee’s own assets and the other trust assets

- The settlor and the beneficiary cannot instruct the trustee

- The trust period cannot be longer than 50 years.

Main advantages of a Hungarian trust:

- No dual ownership concept

- Flexibility

- Strict fiduciary duties

- The trustee is subject to a duty of confidence

- Licensed trustee

- Several types of trust

- Possibility to set up an irrevocable trust

- Possibility to appoint a protector

- Asset tracing

- Right to revoke the trustee at any time

- Right to change the governing law at any time

- Tax neutral treatment

- Tax compliance

- Tax free asset transfer

- Segregated trust assets

- Segregated bank and security accounts for every trust

- No publicly available information about the settlors and beneficiaries

- Developed and solid financial and banking background

The benefits of a Hungarian trust

Hungary offers us great assets protection tools such as the trust. Although based on the typical trust structure, in which assets are transferred to a person or company for the benefit of a third person or persons, Hungary´s trust presents some peculiarities which we describe in this section of our Country Focus.

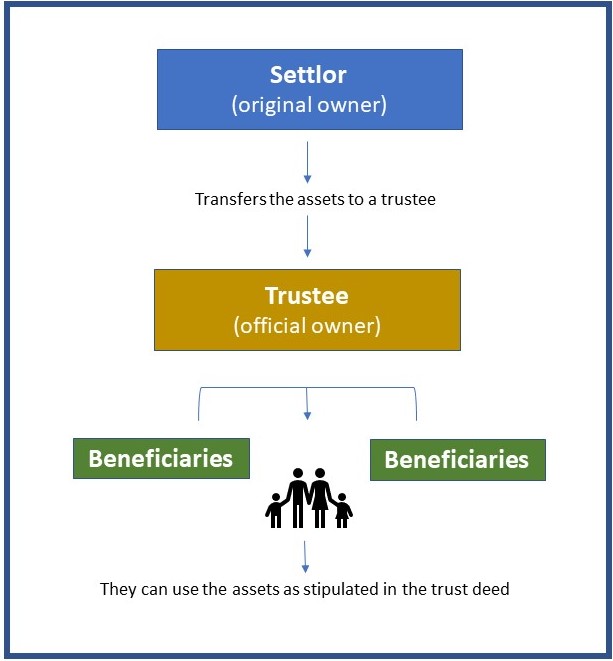

A trust is a legal instrument, similar to a contract, in which an individual transfers his assets to another individual or company called a trustee for the benefit of a third party.

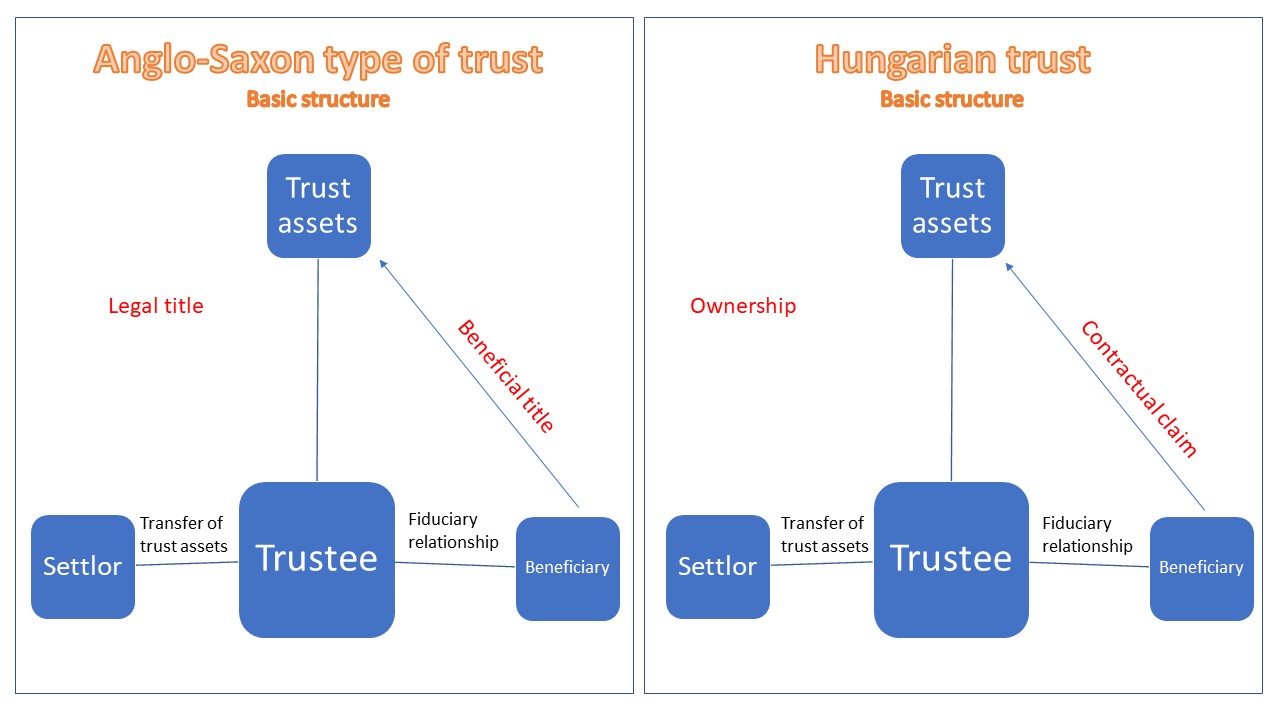

The trust was originated in England, which means its conception is based on the common law system. Therefore, a trust registered under the Anglo-Saxon law presents two different ownerships, legal (the trustee) and beneficial (the beneficiary). This is also known as legal and equitable ownership.

This detail doesn´t make a major difference in a practical sense but it does in a technical one. Being a civil law country, Hungary´s legislation does not contemplate split ownership. For this reason, under a Hungarian trust the assets will be exclusively owned by the trustee and the beneficiaries will have a legal right to them.

In conclusion, the basic structure of the Hungarian trust is equal to any trust and it´s just as effective for asset protection purposes, the only thing that varies is the relation of the beneficiaries towards the assets, e.g. the type of rights that they have over the trust´s property.

As shown in this chart, the beneficiaries of a Hungary trust have contractual rights against the trustee regarding the trust´s assets.

The Hungarian trust still meets the conditions for excellent asset protection since the person no longer owns the assets but remains in control of them. The beneficiaries don´t own the assets but always have the possibility to transfer them to themselves. The structure can also be designed for tax optimization purposes.

The Hungarian trust is formed by the following parties:

- Settlor

- Trustee

- Beneficiary

- Protector (optional)

The settlor

The settlor, like in any typical trust structure, is the one who creates the trust by transferring his property or assets to the trustee or trustee company. The settlor can be any person, individual or legal entity and is the one who stipulates the terms of the trust, being the trustee´s responsibility to carry out the settlors wishes. The settlor has the right to change the trustee at any time.

The Hungarian law is flexible enough to allow a settlor to also be a trustee. In this case there are some restrictions that need to be considered. First, this type of trust, also known as a ‘self-declaration trust’ must be created by a unilateral statement made by the settlor that must be incorporated in a notarial deed. Second, the self-declaration trust will be irrevocable.

The settlor can also appoint himself or herself as beneficiary, but he cannot be the sole beneficiary otherwise the trust won´t be valid.

The settlor has numerous rights under Hungarian law:

- The right to supervise the trustee´s activities at the settlor´s cost.

- The right to request information from the trustee such as information on the trust assets, details on the actual and foreseeable growth of the assets, detail about the assets and the value and description of any obligations taken up by the trust’s assets, information on the asset management. This, however, must be carried out at the expense of the settlor.

- Right for a compensation from the trustee if the terms and conditions stipulated by the trust are not properly met. If the trustee is receiving a fee for his services, then he is liable to the settlor in case of a breach in the trust´s conditions, unless he can prove that the breach was committed not out of negligence but due to unforeseen circumstances. If the trustee is not receiving a fee, then he is not liable to the settlor unless it can be proven that the breach was committed on purpose. Further, the settlor has a right to claim any financial advantage the trustee has acquired through the breach of the trust, and to add such financial advantage to the trust assets.

- If the trustee should quit and there is no person or entity to take up this position, then the settlor is entitled to the trust assets.

- The settlor can appoint a person who will exercise his or her rights and obligations in case of decease. The settlor can stipulate the exact obligations and rights of this person.

The settlor is also bound to some obligations such as paying the correspondent fees to the trustee and making sure the trustee has access to all the necessary information regarding the assets.

Transfer of assets

The assets that are transferred to the trustee can be of any kind, tangible or intangible. The assets must be well stipulated and officially transferred to the trustee, otherwise the trust won´t be properly established. The transfer of the assets from the settlor to the trustee is free of tax for both parties, including stamp duty tax.

The trustee

The trustee will be the person or legal entity that will manage and distribute the assets according to the settlor´s wishes and to what is stipulated in the trust deed. The trustee can be any person as there are no restriction as to who can take up this position and whoever the trustee is, will be supervised by the National Bank of Hungary.

There are two types of trustees:

Ad-hoc trustee: This is the trustee that acts for only one trust. The regulations are more flexible for them and they only need to notify to the supervising authority, the National Bank of Hungary, within 30 days after the creation of the trust and trust deed. The National Bank will register the trust into a non-public database and provide the trustee with a certificate of registration. This certificate will be used to transfer the assets legally and properly from the settlor to the trustee.

Professional trustee: These are trustees that work for more than one trust and they are subject to more rigorous rules. They can only act as trustees providing they have the correspondent license and cannot engage in any activities other than trustee services. A professional trustee can be:

- A limited liability company incorporated in Hungary

- A private limited company incorporated in Hungary

- A Hungarian branch of a company established in a state within the European Economic Area

- A Hungarian law firm

Further, in order to take on this role, a professional trustee entity must comply with numerous regulations regarding personnel, and with operational and structural requirements. An entity acting as a professional trustee must have a license from the National Bank of Hungary and can only engage in trust activities.

The owners and executives of a trustee entity must have an excellent reputation and no criminal record, and the registered capital of the entity must be of at least 270,000USD. The entity must also have enough capital to cover any potential damage that may occur to the assets they manage (at least a 20% of the total of assets they operate with as trustees).

The trustee, either ad hoc or professional, must act according to the trust deed and the settlor’s wishes. If the trust allows it, the trustee can choose the beneficiaries and arrange the distribution of the assets, in other words, the Hungarian legislation allows for a discretionary trust.

The trustee will receive a fee for its services and its obliged to maintain their own assets separated from the trust´s. In case the trustee is target of claims and lawsuits, then he must respond with his own assets.

The beneficiaries

When the settlor creates the trust, he stipulates who the beneficiaries are, what shares are given to each beneficiary and when. Like we pointed out before, it is also possible to create a discretionary trust in which the trustee is the one to choose the beneficiaries and decide the distribution of assets and shares. The beneficiary can be any person or legal entity, assuming that the person is in legal capacity. The beneficiary can also be the settlor or the trustee, but in this case, he or she cannot be the sole beneficiary.

Like the settlor, the beneficiaries have the right to ask for auditing and account information from the trustee and to be compensated if the trustee should infringe the trust deed. This supervision must be carried out at the beneficiaries´ expense. The beneficiary cannot give instructions to the trustee.

The protector

The appointment of a protector is not mandatory; thus, a trust can be set up without a protector.

Assigning a protector is an option that the settlor has in order to provide an extra layer of security to the trust. A protector is

a person, usually an acquaintance of the settlor, whose responsibility is to supervise that the trustee is managing the assets in the way that´s stipulated in the deed and according to the settlor’s wishes and instructions.

A protector becomes useful for supervising those situations for which the trust deed does not provide instructions. Also, the existence of a protector ensures that the settlor´s will is carried out even upon his death or incapacity. The protector can also be authorized to initiate legal procedures against the trustee if a breach should occur.

Taxation of a Hungarian trust

The assets of the trust are not considered a legal person, but they are considered to be a Hungarian tax resident business entity. This allows for tax planification.

Tax advantages offered by a Hungarian trust:

- Dividends are tax free

- Capital gain from alienation of qualified participation is tax free

- 50% deduction of any royalty received from the pre-tax profits of the trust´s assets

- Flat annual rate of 9% for income tax (lowest corporate income among the EU members and the second lowest among the OECD countries).

- Local taxes which vary from 0% to 2%. The local taxes that the assets are subject to will depend on where in Hungary is the trust registered. If the trust is registered where local taxes are imposed, then the assets will be subject to those tax rates.

- If real estate property is part of the trust assets, the property may be subject to local tax on property.

The trustee is not subject to corporate, personal, or local taxes from the distribution of the trust´s assets. The beneficiaries may be subject to taxation depending on their residency, tax residency, and depending on the type of transfer and from where this transfer is carried out.

When transferring the assets to the beneficiary, they may be subject to stamp duty tax which is 18% of the market value of the correspondent item. For real estate property the stamp duty tax is 9%.

Stamp duty is only applicable when the transfer takes place within Hungary, and the beneficiary is subject to stamp duty regardless of his or her tax residency.

When the beneficiaries are direct descendants of the settlor, e.g. spouse or children (even adopted children) then they are not subject to stamp duty tax.

A tax exemption is possible if the settlor and beneficiaries are natural persons. This is possible if the income received during the fiscal year comes from the receipt, holding of financial instruments, securities or funds, or receivables.

If the settlor and beneficiaries are natural persons exclusively, they can open a long-term investment account for a trust. Thus, investments can be made from the trust in financial instruments, controlled capital market transactions, and bank deposits that bear interests. After 3 years, yields from this investment account can be distributed to the beneficiaries with only a 10% personal income tax. After 5 years, yields can be distributed with a 0% income tax, i.e., beneficiaries will be free of personal income tax from these yields.

Download comparison chart on tax liabilities

Excellent asset protection structure

The trust has proven to be an exceptionally effective asset protection tool since the Crusades, where the knights would leave their property to their servants for protection (women and children were not allowed to hold property under their names) and would claim it upon their return. Many centuries later, the trust structure has evolved and now most wealthy families use it to protect their assets from potential dangers such as confiscation and legal claims.

Every rich family is exposed to these kinds of threats from those who are after their assets and wealth and that is why, at Mundo, we strongly recommend setting up a trust. A smartly designed trust will protect your assets and your family´s forever.

It is as simple as this: since the assets are legally owned by the trustee (not by the settlor nor the beneficiaries) then they cannot be seized. A claim against the assets of a trust in Hungary may only be made under limited circumstances, such as is if the person can prove that the claim existed before the trust registration and that the trust was created in order to avoid paying for this claim.

This is not easy to do because it will require that:

- The legal action happens in Hungary.

- It must be proven that the claimant already had a valid claim against the settlor before the trust incorporation.

- It must be proven that the other assets of the settlor (those that are not under the trust) are insufficient to satisfy the claim.

- The claimant must prove that the settlor acted in bad faith when registering the trust.

- All these proofs must be gathered by the claimant.

If this happens, even with extremely low chances, and the claimant can satisfactorily prove these points beyond reasonable doubt, then the trust deed is not deemed invalid. The trust will not be set aside, but the claimant will have claiming rights over the assets in litigation.

Claims against the trustee will not affect the trust’s assets as the trustee keeps his own assets separated from the trust´s. Any claimant that would go against the trustee´s assets, or the assets of other trust managed by the same trustee, won´t be able to reach the trust.

Regarding beneficiaries, they can only be subject to claims on the trust property once the assets have been already distributed and transferred to them. An additional layer of protection is added because the timing of the distribution is set up by the settlor or the trustee, depending on the case. They will be both bound to act for the utmost benefit of the beneficiary.

Enforceability of foreign judgments in Hungary

Every well-established trust must consider all the potential risks in order to effectively protect the funds. At Mundo we always advice our readers who want to set up a trust, to research the jurisdiction where the structure will be established. It is extremely important to not only consider the legislation of the incorporation jurisdiction, but also the enforcement of foreign legislation in this jurisdiction. It is vital for international family offices, businesspeople, and investors to carefully consider this aspect when establishing any business and especially a trust.

Since one of the main objectives of this structure is asset protection, in this section we cover not only the possible risks that may come from a domestic environment but also from abroad. We consider it will be useful to examine under what circumstances foreign judgement is implemented in Hungary as this may challenge the effectiveness of the trust.

In general, upon establishment, the parties can choose the jurisdiction whose laws will regulate the trust. However, there are certain situations where the Hungarian law has exclusive jurisdiction. Any decision made by a foreign court that relates to any of the following instances will not be recognized by Hungarian court:

- Proceedings pertaining to any right in real estate property situated in Hungary, including the rent or lease of such property.

- Probate proceedings where the estate is located in Hungary and the testator is a Hungarian citizen.

- Actions filed for the destruction of official instruments issued in Hungary.

- Proceedings concerning the registration of rights, facts, and data into a public register in Hungary.

- Actions concerning enforcement procedures in Hungary.

The Hungarian courts do not have jurisdiction over the following matters:

- Proceedings pertaining to any right in real estate property situated abroad, including the rent or lease of such property.

- Probate proceedings where the estate is located abroad, and the testator is not a Hungarian citizen.

- Actions filed for the destruction of official instruments or securities issued abroad.

- Proceedings in connection with the granting and termination of industrial property rights abroad, including the contents thereof.

- Proceedings concerning the foundation and termination of a foreign-registered legal person in proceedings concerning the validity of the contract or instrument of constitution underlying the registration of the legal person, and in proceedings concerning the review of the resolutions passed by the organs of legal persons.

- Proceedings concerning the registration of rights, facts, and data into a public register abroad.

- Actions concerning enforcement procedures abroad.

It is important to note that if a court seeks the recognition and enforcement of its decision in Hungary, they can apply for legal assistance from Hungary. In such a case, the Hungarian court will only provide assistance for the recognition and enforcement of the foreign ruling based on the agreement on legal assistance that exists between the EU and the foreign country.

For US citizens, Hungarian trusts are very safe as the courts won’t recognize any claims from the United States. If a claimant from the US would want to start a legal action against a trust in Hungary, they would have to do it in Hungary before the Hungarian authorities. You can imagine how costly and difficult this procedure would be and, due to the local legislation that protects the trust structure, these efforts will most likely be in vain.

Thus, a Hungarian trust offers excellent asset protection options for international investors and businesspeople. Contact us now and ask for a consultation in order to set up your trust in Hungary.

Comparison with other trust jurisdictions

Hungary may not be the most popular trust jurisdiction but, when compared to countries like Nevis, Cook Islands or Saint Vincent, it shows many advantages. The Hungarian trust is similar to the trust structure you will find in Nevis, the Cooks Islands and Saint Vincent when it comes to protecting the assets and interests of the settlor and beneficiaries. The assets are very difficult to reach, and the law only allows

creditors to claim any of the assets held under the trust under very limited circumstances. Like we discussed above, the only way a claimant can reach these assets is if he can prove beyond reasonable doubt that the trust was created to avoid this claim in the first place. Moreover, in most cases (when there is no reciprocity between Hungary and the other jurisdiction) the claimant will have to present his claim through the Hungarian legal system, having to overcome many barriers including language.

Some countries and jurisdictions that do not have a reciprocity contract regarding legal claims with Hungary include the US, Kazakhstan, Uzbekistan, Indonesia, Malesia, India, Hong Kong, and others. Going against a trust in Hungary will cost the claimant a considerable amount of time, money and headaches and they would have small chances to win the case. Therefore, Hungary is a safe jurisdiction where to establish your trust and has the same level of protection than a trust in, let´s say, Nevis.

However, we would like to focus on the difference between Hungary trusts and those from the most popular trust jurisdictions. We can clearly see that Hungary has advantage over them thanks to its political and legal stability, sophisticated infrastructure, high tech innovations and wealth management and estate planning options. Let´s go through some of these differences.

Stability and reliability

Saint Kitts and Nevis and Saint Vincent are relatively new countries which acquired independence only in 1983 and 1979, respectively. The Cook Islands is a self-governing state and is highly dependent on New Zealand, which is responsible for the islands´ defense and foreign affairs. None of these countries have the historical background that Hungary has, being the second oldest country in Europe. Hungary´s state was founded in A.D. 895 even before France and Germany became separate states.

Undoubtedly, Hungary has a long-term stability and reliability which is hard to match.

Accounting in accordance with the EU standards

In our globalized economy every businessperson and entrepreneur needs to consider international investment and business. However, the options to develop your business internationally have become narrower due to the increase in regulations.

Nevis, Saint Vincent and the Cook Islands are great jurisdictions for asset protection, we are not objecting to that, but even though they are now complying with the OECD regulations, they are still not considered reputable countries in some regions. The nickname of tax haven is still a burden that some of these countries carry with them, although tax havens do not exist anymore. Having a trust or a business in some of these former tax havens may result on higher resistance when opening bank accounts or incorporating companies abroad. It is not impossible, of course, but you will likely be subject to major requirements and longer due diligence process.

Hungary is a European and EU country which complies with all the correspondent accounting requirements. Going through due diligence processes will be much more straightforward when your assets are held under a Hungarian trust or if you have an operating company in Budapest.

All of Hungary’s listed companies and financial institutions must prepare non-consolidated financial statements according to IFRS standards. When it comes to a trust, for example, the trust´s assets are accounted for in separate records than other entities. The trust´s records are not made public as opposed to the profits and losses of a regular company.

The compliance with such strict accounting regulations may be difficult but there´s nothing that you cannot solve with the help of a good accountant. It is the writer´s opinion that going through such strict processes is worth it as it makes international expansion easier. With a structure in Hungary you will easily prove the source of your funds and that you are absolutely tax complaint before any authority anywhere in the world.

Sophisticated legal system

The legal systems of the Cooks Islands, Nevis and Saint Vincent are based on British common law. This system is partly codified and partly based on case by case premises. This makes room for a high degree of uncertainty when it comes to legal claims or issues someone may encounter. Moreover, their legal system generally consists of 2 levels.

In Hungary, the legal system is based on the Fundamental Law of Hungary and it´s ruled by civil law. Justice here is administered in four levels which are the Curia, the Regional Court of appeal, the Regional Court, and the District court. Thanks to its civil law system and to the fact that it´s protected by the EU legal scheme, Hungary offers a solid legal framework where to safely develop your business, manage your wealth and structure your tax plan.

High tech country with easy administration processes

The public administration in Hungary uses modern information and communication technologies for the interaction between government institutions and citizens. During the last five years the Hungarian government has improved the system for business and individual administration.

Many procedures can be carried out entirely online, making it remarkably simple to follow every requirement via straightforward processes and minimizing the bureaucratic burden.

These are some of the procedures that can be carried out online:

- Personal & company annual tax returns

- VAT returns

- Company registration (via an attorney-at-law)

- Statistical data provision

- Customs declaration, etc.

In this chart you can easily see the advantages of a Hungarian trust over other jurisdictions.

Download trust comparison chart

Foundations in Hungary

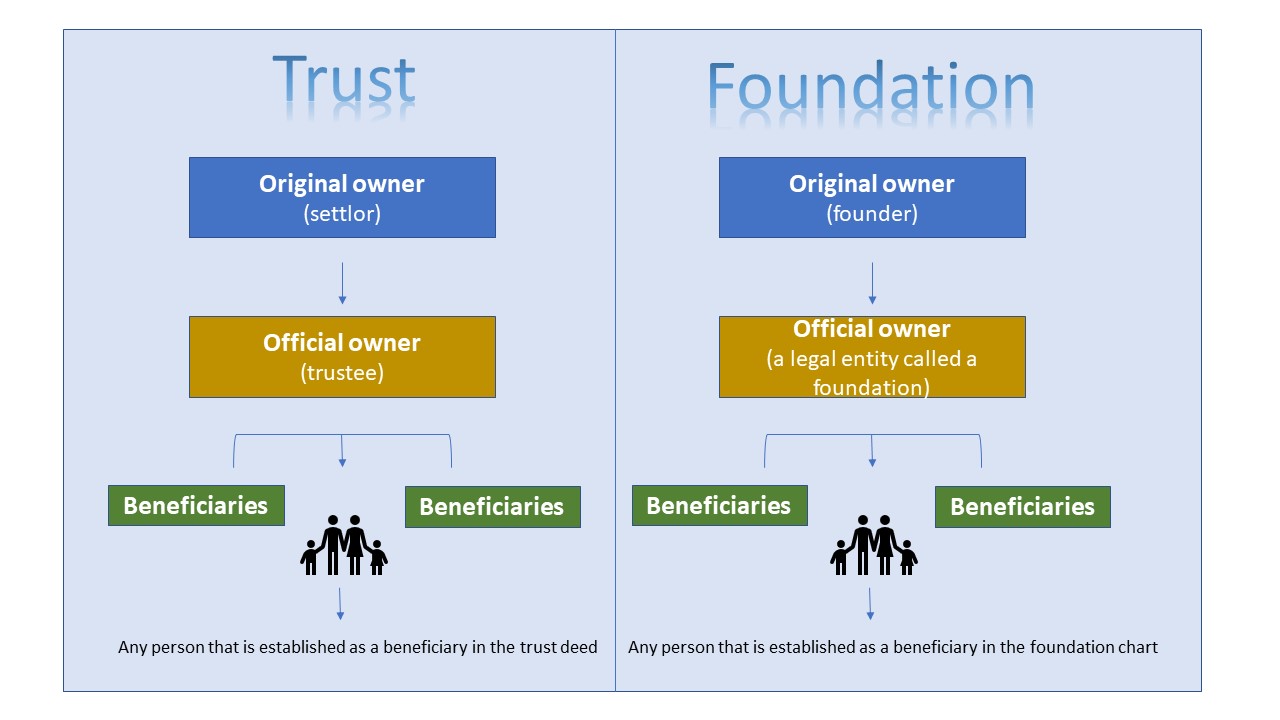

Hungary offers two main estate planning tools: the trust and the foundation.

The trusts and the foundations are similar in structure as both are based in the transfer of assets to a person or entity for the benefit of a third party. The main difference between these two is that the trust is a mere contract between two people or one person and a trustee company. The foundation, on the other hand, is a legal entity that is not owned by anyone. Unlike a company, which requires a paid-up capital to be established and is owned by the shareholders, the foundation does not have any owners and is established with a deposit. For example, in Panama the minimum deposit to establish a foundation is 10,000USD.

In a company, the paid-up capital is divided into shares, which establish the ownership percentage of each shareholder. The deposit made into the foundation at the time of its establishment is a capital that won´t be owned by anyone, but will belong exclusively to the foundation and can be used or distributed according to the founder’s wishes.

In Hungary, Thanks to the civil code amendment made in 2014, it is possible to establish a foundation without the intention of a long-term public benefit. Nowadays, any individual can establish a private foundation, however, this structure presents some restrictions.

The civil code states:

Unless otherwise provided for in this Act, a foundation may not be established in the interest of its founder, any member current or future, any officer of the foundation, any member of a foundation organ, or the family members of these persons.

However, the civil code states further:

The founder and the co-founder may be a beneficiary of the foundation, if the foundation is established for the purpose of caring for the founder’s scientific, literary, and artistic works.

The founder and the co-founder may be a beneficiary of the foundation, if the foundation is established for the purpose of caring for the family member’s scientific, literary and artistic works, or the caring, nursing or maintenance of the family member, covering the family member’s medical expenses, and supporting his education by way of scholarship or otherwise.

Although, according to the civil code, it is possible to create a foundation and be the beneficiary at the same time, this can only be made for strict and well stipulated purposes. It is clear that the Hungarian law protects the trusts more than it does foundations, and the trusts also offer more tax benefits. Being a legal entity, the foundation will be more strictly regulated because it has a regulating organ. The trust, on the other hand, is only a contract made between two parties and it only requires a license from the National Bank of Hungary (if you use an ad hoc trustee then you don’t need a license, but only to notify and get a certificate from the National Bank).

For the reasons mentioned above, the trust is undoubtedly a more flexible structure and is the best asset protection and tax planning tool that you can find in Hungary.

The best asset protection option: asset management foundation in Hungary

In 2019 the Hungarian legislator introduced a new structure that was able to take Hungary to the next level on asset protection and estate planning. This structure is called Asset Management Foundation (AMF from now on) and it´s the perfect hybrid between a trust and a foundation providing more flexible conditions. The AMF is a special form of foundation that can perform asset management activities including trust services. These structures are so powerful that are even used by the government for the purpose of managing some of Hungary´s most prestigious universities. This hybrid provides a wider range of flexibility than the traditional Hungarian trust:

Indefinite duration:

Like we pointed out before, a trust in Hungary has a limited duration of 50 years. The AMF, on the other hand, does not have any time limitations, thus opening the possibilities for intergenerational asset protection and estate planification. Now Hungary can also offer long term asset protection.

More control:

The Hungarian Civil Code does not allow for the settlor and beneficiaries to give instructions to the trustee. Thanks to the AMF this prohibition can be avoided. If a trust service is provided through an AMF, the founder (the equivalent to a settlor in a trust structure) is allowed to give instructions to the foundation board, even in the scope of distributions to persons or entities that will be defined by the founder later on.

More confidentiality:

The trustees are subject to professional confidentiality under Hungarian law. However, they can disclose information to public authorities if required. This exemption does not apply if the trustee services are offered by an AMF structure.

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

When people obtain new citizenship, they often think about documents, taxes, or minimum stay require...

Have you ever dreamed of becoming part of history? In Panama, such a dream has an address — Casco Vi...

Panama is a place where the sun rises early and everything happens at the right moment. Every step h...

Understanding what a beneficiary and the concept of an ultimate beneficial owner is is essential for...

At Mundo, we are constantly searching for the latest news and changes in the CBI industry. In the pa...

When you first arrive in Panama City, the skyline feels alive, shimmering with reflections of light....

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)