Obtaining a financial license in Cyprus

After a severe economic crisis in the aftermath of the European debt crisis, Cyprus has been one of the models in the European Union. The island reformed its economy and as of today, it’s one of the most thriving countries in the EU.

This heavenly island enjoys a privileged climate and location that has always made it a popular touristic destination in the Mediterranean.

10,000 years of history, otherworldly beaches, 340 days of sunshine per year, and a relaxed and welcoming foreigners’ local populations are some of the reasons why so many Europeans love Cyprus.

But we love Cyprus for another reason. Don’t get us wrong, we also adore its heavenly beaches, but we’re in love with the home of Saint Mamus for another reason: Its flourishing and cutting-edge financial services.

Cyprus has become, alongside Malta, the top Mediterranean destination for investment firms.

Why?

Because companies around the world are facing an increasing amount of pressure to comply with stricter regulation and regulatory bodies around the world are gaining more and more authority to ensure that business licenses are in place. Thus, such a process means they will spend a ton of time and money dealing with regulatory entities.

Add to that the fact that tax authorities also have more power and many countries, especially in the EU, are applying high-tax policies, and you’ll understand why the future for financial service providers seems bleak. It seems that operating an investment firm isn’t too attractive in the EU anymore.

But here is when Cyprus comes in.

The corporate tax rate in Cyprus is 12.5 %, which is one of the lowest of the EU alongside Ireland. Moreover, Cyprus has exceptions from dividend participation, capital gains (in some instances), profits from securities, and no withholding taxes.

On the personal side, if you’re a tax resident in Cyprus, and you can achieve a non-dom status by only spending 60 days in the island, under certain conditions, you’ll get a 50 % personal income tax exemption for ten years if your income is over €100k. You’ll be exempt from the Defense tax for 17 years.

That means you’ll have a personal exemption of the regular 17 % personal dividend income, 30 % passive interest income, and 2.25 % rental income contributions.

Moreover, Cyprus has simplified its procedures for obtaining a financial license to operate an investment firm.

All this has led Cyprus to become a top-notch financial licensing jurisdiction with full EU passporting rights, a strong regulatory framework, and plenty of incredible tax optimization possibilities.

If you’re not still convinced that Cyprus is the best destination for your investment firm, let’s walk you through some of the benefits.

Why Cyprus? Five reasons to obtain a financial license in Cyprus

Multi-purpose license

One Cypriot Investment Firm license will allow you to provide nine main financial services and seven ancillary services. In many countries, you need a variety of different licenses for almost every service you wish to provide, and that costs time and money. That’s not the case with Cyprus, as you can handle many different investment services with one single license.

Tax optimization

A 12.5 % corporate tax rate and no dividend and capital gains taxes, nor withholding taxes or taxes on profits from securities. No taxes on your firm’s foreign-sourced income.

And on the personal side of the equation, you can get a 50 % personal income tax credit for ten years if you are eligible for the non-dom status, which will also grant you a tax exemption on personal dividend, passive interest, and rental income.

Pro-business government

Cyprus made a giant leap towards pro-business policy after the 2013 economic crisis. They put a ton of tax incentives on the table and opened the country for investors, creating an attractive non-dom status, approving tax credits for fund managers, creating CBI and RBI programs, and reforming banking laws so banks could securitize loans. This reduced non-performing loans and gave the island an influx of fresh FDI that has since revitalized the Cypriot economy.

Passporting rights

Establishing an investment firm in Cyprus will give you full access to the EU market. You can carry out your business in other EU states without additional licenses for other states, which means a Cypriot license will allow doing business freely all across the EU.

Straightforward process

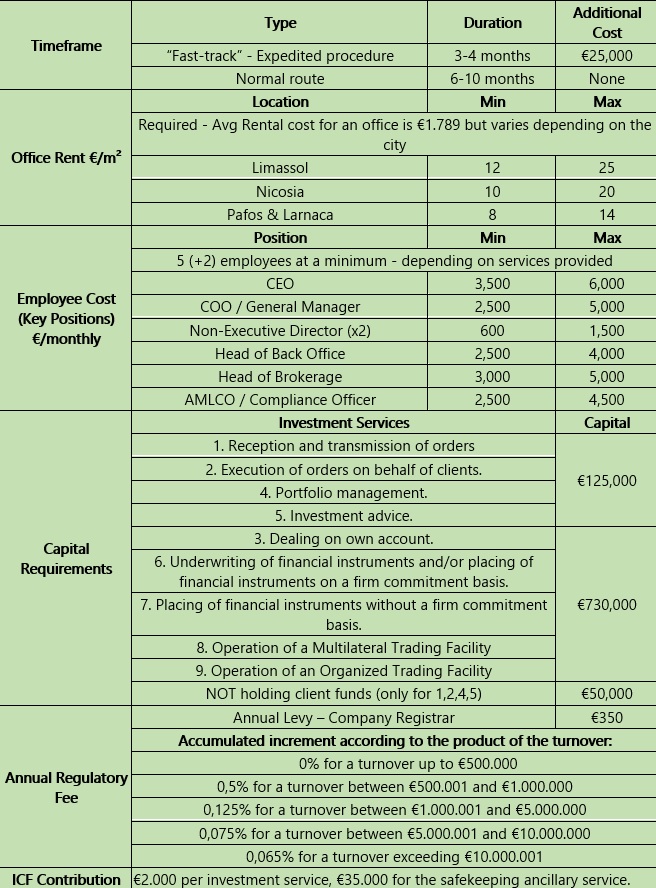

As usual, obtaining a financial license isn’t a simple process. Nevertheless, the steps to get a financial license in Cyprus are stringent enough to allow only legit players but flexible enough to be attractive. If you apply by the regular path, you’ll receive an answer in 5-6 months, if you apply using the fast-track path (for which you must pay €25k), you’ll receive a response in a mere two months.

Costs and procedures for a financial license in Cyprus

In these tables, you have everything you need to know regarding costs and main requirements to obtain a financial license in Cyprus:

Now, after seeing all the main requirements and their attached costs, you are probably wondering where to start.

Investment firms in Cyprus must be licensed by the CySEC (Cyprus Securities and Exchange Commission). This license will allow your firm to provide financial assistance all across the EU without needing representatives, branches, or additional license.

A simple notification procedure will allow you to operate in other EU countries from your Cyprus office. This includes brokerage services, portfolio management, market-making, and general investment advice. Your firm must have at least two executive and two non-executive directors, of which the majority must be based in Cyprus.

At least three of the firm’s employees must be locals: head of back office, compliance officer, and chief of dealing room.

Moreover, you should also comply with some minimum capital requirements: For brokers who don’t hold client funds: €50k

● For brokers who hold client funds €125k

● For market makers: €730k

Legally, the process takes six months through the regular route and two months through the fast-track route. On top of that, you must add two months, which is the usual time it’ll take to prepare the application.

What else do you need to know?

● Only legal entities based in Cyprus can apply for the license

● The firm needs an adequate local office with all the necessary personnel (see the table)

The application procedure involves submitting an Application Form to obtain CIF authorization. The form provides all the main information about the firm, the services it will offer, its shareholders, directors, and senior managers. It has to be joined by these documents, as long as they apply:

- Incorporation Documents of the Company:

- Certificate of registration/incorporation from the Registrar of Companies

- Certificate of shareholders

- Certificate of the registered office from the Registrar of Companies

- Certificate of good standing

- Memorandum and Articles of Association

- Certificate of the applicant’s directors and secretary

- Capital Evidence – All relevant agreements, contracts, certificates proving the existence of Capital raised.

- Shareholders Documents – In the case of Legal Entity, the same documents as point 1 above apply, in the case of a Natural Person, then a certified copy of ID or Passport a Proof of Residence and a CV is required. Personal questionnaires dully completed from each Natural Person and/or UBO (persons that exceed 10% shareholding in the Company)

- For each Senior Management / Director:

- Certified copy of ID or Passport

- Non-bankruptcy certificate

- Clean criminal record

- Personal Questionnaire

- Organizational structure chart of the Company

- Business Plan

- Company Manuals

- Internal Operations Manual

- AML Manual

- Certifications of the representative for external auditors and legal advisers of the Company

- For existing/already established Companies, annual financial account statements for the last three year.

What services can an investment firm provide in Cyprus after licensing?

After obtaining and authorization, such a license will allow you to provide all main investment services, such as:

- Investment services:

- Reception and transmission of orders regarding financial instruments

- Execution of orders representing clients

- Dealing on own account

- Portfolio management

- Investment consulting

- Underwriting of financial instruments and placing of financial instruments on a firm commitment basis

- Placing financial instruments without a strong commitment basis

- Operation of a Multilateral Trading Facility (MTF)

- Operation of an Organized Trading Facility (OTF)

- Ancillary services:

- Safeguarding and management of financial instruments for clients.

- Granting credits or loans to an investor to permit him to conduct a transaction in financial instruments, when the firm granting the credit or loan is involved in the transaction.

- Advice on capital structure, industrial strategy and similar matters and consulting and services linked to mergers and the acquisition of undertakings.

- Foreign exchange services as long as these are linked to the provision of investment services.

- Investment research and financial analysis or other ways of general advice and research relating to financial instrument transactions

- Services related to underwriting

Who are we, and what can we do for you?

Mundo experts have more than two decades of helping investors and high-net-worth individuals protect their assets and expand their operations.

One of the most sophisticated and solid asset protection and portfolio diversification strategies is establishing an investment firm that will give you access to a wide array of investment funds.

We know that one of the most troublesome aspects is obtaining the license itself. It’s easy to get lost in the process, and it can be costly. Without a helping, experienced hand, it can seem like an almost impossible task.

But, we’re here to help. Our experts in Cyprus are among the top service providers in Cyprus. They are a talented multidisciplinary team that will help you from the beginning of the process (creating a corporate structure) to the end (operating your firm post-licensing).

This process usually takes months of preparation, money, and stress, without the certainty of knowing if you’ll obtain the license. But our experts will simplify this process for you.

Whether you are a Broker, IB or Asset Manager, Market Maker, EMI, PI, or a Banking Institution, we can help. Our experts are dedicated to providing you with full guidance and regulatory compliance to help you plan and structure every aspect of your investment business.

That means they won’t limit themselves to just advise you in gathering the documents to apply for the license, but they offer a full set-up package for you to obtain a fully licensed and operating firm.

Our team is specialized in helping our clients set up their FX, CFD, Market Making, Cryptocurrencies, and Investment Brokerage Firms as well as ICOs, E-Money, and Payment Institutions in Cyprus.

The process with our team is a simple five-step process:

1. Registration of the firm’s name

2. Incorporation of the firm

3. Registration of the firm with the local authorities (social security, VAT, tax)

4. Acquiring the license

5. Activation of the license

Thus, if you work with Mundo, our experts will help you with:

● Incorporating your firm and registering it with all relevant authorities

● Preparing the application package

● Reviewing the package to improve your chances of obtaining a license

● Assistance in obtaining a license for additional services

● Assistance with setting up branches and offices across the EU thanks to the passporting rights and much more

● Offering tax-optimized, tailor-made licensing solutions

Cyprus is one of our favorite financial licensing jurisdictions. It’s a top entryway to the European market that comes with fantastic tax and regulatory benefits. It’ll be the first step towards reaching top asset protection.

Want to obtain a financial license for an investment firm in Cyprus? Enquire now!

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Having structures abroad, like companies or bank accounts, can significantly boost your projects, br...

The Caribbean is entering a decisive stage of transformation. Regional governments are introducing u...

We think that the most challenging part of choosing a CBI is considering the minimum investment, the...

The world map is covered with shades of blue, yet only a few places make time stand still. Among the...

The waters of the Caribbean and the sands of the Persian Gulf may seem like very different worlds, y...

By constantly finding new opportunities, we can help readers achieve their goals and find what they'...