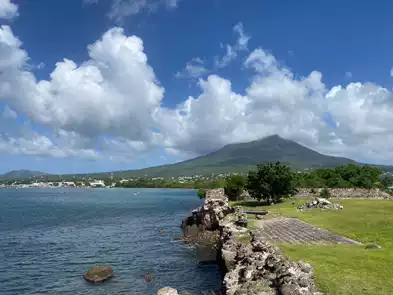

Nevis LLC: Maximizing Flexibility, Tax Efficiency, and Confidentiality in International Business Ventures

Canada included in the visa-free list in three Caribbean CBI countries

Just when we thought that things wouldn't get more interesting in the CBI world, recent changes in citizenship laws seem to indicate otherwise. More precisely, we're talking about new Caribbean passports visa-free options: there's a new country that citizens will be able to visit.

Unlock Global Opportunities: Exploring the St. Kitts and Nevis Citizenship by Investment Program

Brand new opportunity in Latin America: a license to bank without a bank with a Mexican SOFOM

At Mundo, we understand the fundamental role financial freedom plays in shaping the prosperity of international investors. For us, this concept transcends conventional limits and continually paves the way for fresh opportunities to unlock the immense potential of global wealth. In line with our commitment to discovering innovative financial products, we’ve decided to explore the Mayan lands.

.jpg.medium.WebP)

Vanuatu Citizenship by Investment: Unlocking Boundless Prospects

Mundo's insight into the future of residency programs in Panama

Statistics show that foreigners focused on finding the best residency still choose Panama, but they are more inclined to choose self-solvency visas. Apparently, the future of Panama and its migration landscape may be changing soon, or may it not? Mundo analyses the current outlook of investment residency vs self-solvency in our favorite country.

Corporate accounting in Panama: the essentials that every business owner must know

In the business world, nothing is more important than stability. Together with diversification, these are two characteristics that you can't dismiss when putting together your plan. Moreover, if your financial scheme includes a corporation, corporate accounting must be carefully approached. International businesspeople have to pay special attention to this as they usually have structures across different jurisdictions that, naturally, have their own rules and legislations.

How to emigrate safely: the dos and don'ts for choosing your second citizenship

Offering investment migration opportunities is more than providing services for a fee: it's about teaching best practices when getting a second citizenship. Whether we like it or not, the question of how to emigrate safely touches us all including high-net-worth individuals. Choosing among the available programs can be difficult especially because some of them are quite similar. For such an important decision one needs to be 100% sure.

Panama Friendly Nations Visa: Embrace a World of Welcome and Endless Possibilities

Panama has

long been known as a land of opportunities, attracting individuals from

around the globe with its growing economy, stunning natural landscapes,

and rich cultural heritage. For individuals aiming to achieve or pursue

embrace the lifestyle in Panama and tap into the country's prosperity,

Panama Friendly Nations Visa presents an enticing avenue. In this

article, we will explore the intricacies of this residence program.,

explore its benefits, and assist you in navigating the procedure for

acquiring residency via Panama Friendly Nations Visa.

Panama visa options: exploring investment opportunities for non-friendly nations

Panama is a shimmering jewel that connects people and continents: North and South America. It’s also a haven for business and immigration, offering a harmonious blend of advanced economy, convenient location, political stability, and a welcoming culture. Whether you're seeking economic growth or simply to invest in Latin America, aiming to move to Panama legally, the country presents diverse opportunities that cater to the digital nomad and anarcho-capitalist individuals.

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Many things attract tenants and short-term renters to a building. Besides location and the number of...

Half a century ago, Singapore was a small port city with limited resources and uncertain prospects. ...

In search of the best banking options, we typically look at Caribbean jurisdictions or countries tha...

Sometimes a single document can determine the fate of entire generations. A trust can be a highly pr...

When Spanish ships searched for new routes along the Pacific coast of Panama, the distant islands of...

Panama has long been a magnet for real estate investors. The country combines a steady flow of touri...