Few People know that Russia has its own managed fund structure which is a hybrid between a trust and a Fund guaranteeing full UBO confidentiality and tax optimization. Russian call this the PIF or Unit investment fund. Using this structure, you can invest in all classes of Russian assets with full control and tax optimization, and yes, it is fully open to foreigners.

You can reach a high level of government protection through mutual funds and closed-end mutual funds, as well as all the other advantages we mentioned earlier. These asset-based approaches are similar to trusts and investment funds, as well as many other perks that often attract investors to offshore jurisdictions.

If there’s something closed mutual funds are known for, it’s their high confidentiality level.

This is mainly because the owners’ registry of such funds is closed, and the direct information exchange on closed mutual funds within the structure of the CRS can’t be done because of the legislative quirks of the Russian Federation. In any case, to open bank accounts and perform other operations, all you’ll ever really need is the name of the trustee.

But let’s move on, a management company is a separate legal entity with certified professional managers and owned assets of at least USD 20 million. All assets remain under the control and supervision of the Central Bank of Russia. This bank legally supervises and provides additional protection to the shareholders. Likewise, the Criminal Code sets out a personal financial responsibility with the fund contributor.

According to the legislation, it is not possible to dispose the assets of the investment fund without the consent of the shareholder (beneficiary). Aside from that, the separate property of the investment fund cannot be disposed of because of the debts of the owner of the fund’s shares.

To put it simply: know that the high level of security provided by a closed mutual fund is similar to that of public limited companies or even complex holding structures. The transactions with fund ownership are fulfilled by the management company, but many funds are actually managed by the shareholders.

Since these funds are not legal entities, they can invest without strict restrictions in bonds, stocks, financial instruments, other funds, ETFs, derivatives, any hedging strategy, real estate, currency, precious metals, as well as art objects, automobiles, jewelry and wine collections. But, there’s something to keep in mind here: doing business with an investment fund (or “in the context of an investment fund”) is always associated to comply with a number of rules and requirements controlled by the Central Bank of Russia, which means low-risk for the partners and even more reliability for the party involved in the investment fund.

Therefore, mutual funds are an excellent tool for doing business in the construction sector, real estate management and land ownership (since they let you bypass the ban on selling rural land to non-residents), as well as in the loan market and in debt obligations.

Aside from having a decent level of confidentiality and reliability, these funds are also a great way for you to optimize your taxes: there are two tax levels in an investment fund, the first one being the investment fund’s own income (which is completely exempt from income tax), and the second one is the shareholder’s taxation.

In this case, there are certain tax features depending on the shareholders’ country of residence (from obtaining tax benefits to total exemption). This means that revenues produced by the fund from property sales or leases, dividends, interest and any other income, are exempt from income taxes, allowing for reinvestment without loss. Property taxes are also paid at the expense of the fund itself if the fund includes this type of asset; remember the fund’s shareholders own investment shares and their taxation is based on the rules of securities taxation.

Keeping that in mind, an open-ended mutual fund works almost the same, but it doesn’t allow you to directly manage its investments; that means it is a great tool for passive income and fund retention, and can be a good way of doing business when the financial model is built properly.

- Choosing a management company

- Registering mutual fund trust management rules with the Central Bank of Russia

This whole process takes almost one and a half months, but in some cases, you can buy an investment fund which has already been created. When forming a mutual fund with securities, the fund’s shareholders must have the status of qualified investor, which for a non-resident means holding more than USD 100,000 in a bank account.

About our partner

Our partner, Andrey Likhachev, is a professional lawyer in the field of asset management and an active partner and head of a Family Office in Russia, under the management of an international company.

He also has a license of the Federal Financial Market Service for the management of investment funds, mutual funds and private pension funds. He runs private investment funds as a Family Office.

Having professional experience working with banking institutions and specialized management companies of the Central Bank of Russia, he provides full management support for creating structures for PIFs.

- Establishing and servicing Bank accounts for foreign companies and individuals

- Establishing residency and tax residency for foreigners

- Supporting investment into Russian assets including distressed assets, bonds and stocks and acquisition of large medium and small businesses

- Joint venture negotiation

- Establishing PIF investment funds

What is PIF or Mutual Investment Fund?

A mutual investment fund (PIF) is a pool of property of persons and legal entities, managed by a specialized management company. All property that makes up a PIF is in a shared ownership of the participants of this fund. The PIF itself is not a legal entity.

The property of the Mutual Investment Fund is managed by a management company acting under the license of the Bank of Russia and the registered rules of trust management of the mutual Fund.

Investment funds in Russia

18 years of experience (1993-2011)

The development of the Russian investment funds started in Tokyo in 1993, where the representatives of the G8 agreed on the allocation of funds for the development of venture capital projects under the auspices of the EBRD (European Bank for Reconstruction and Development).

The amount of 500 million dollars was supposed to be shared between venture capital funds, under the EBRD´s control and also under the control of other funds organized in Russia on a regional basis.

In the year 2001 the Federal law on investment funds №156-FЗ came into force, and later, in 2003-2005, the closed-end mutual funds appeared in the picture, including venture capital funds and private equity funds.

Nowadays in Russia there are 60 venture capital funds and 35 private equity funds.

The total investment adds up to 100 billion rubles.

The investment fund market in Russia supports different innovation projects that are currently being developed.

Moreover, in Russia there are also foreign venture capital funds, thanks to which it is possible to take advantage of foreign tax and corporate legislation.

One of the most important closed-end mutual funds is the Russian private equity fund under the aegis of the VEB, which is a government institution and the main development corporation in the country.

Main characteristics of an investment fund in Russia

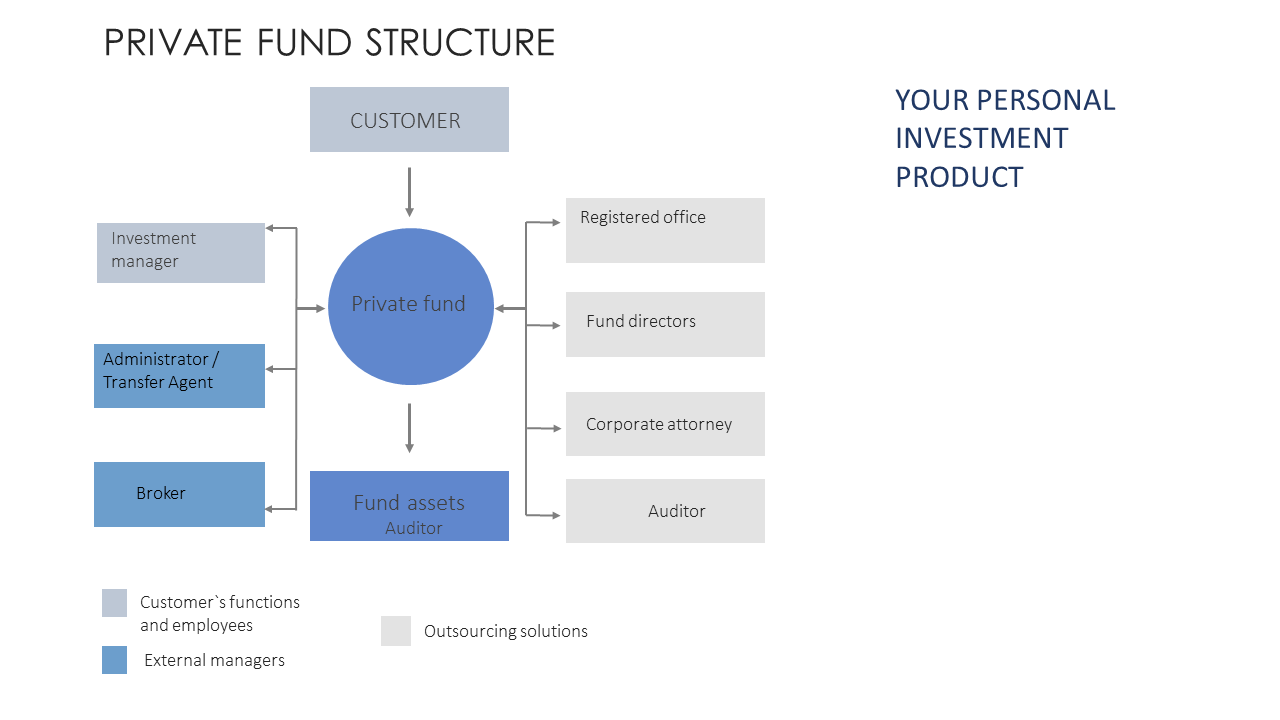

A flexible and comfortable investment

- The Private Fund allows the possibility of using financial instruments in countries that are registered to the automatic ex-change of financial information (OECD Automatic Exchange Information Standard).

- Family Office or professional portfolio managers can safely manage the assets of family members, based on a strong and firm structure.

- The possibility of combining the assets of family members or friends, in order to implement a combined investment strategy.

- Private funds provide high confidentiality levels as the beneficial owner´s information is not disclosed.

The name of the fund is chosen by the client, the client is completely free to choose assets, distribution, transactions, etc. (subject to the availability of an appropriate legal structure).

- Advanced reports. Individual reporting is possible through the fund administrator.

- Net asset value calculations allow monitoring and performance control.

- Thanks to the tax and financial instruments it is possible to obtain additional profits and to defer tax payments.

- Ability to attract credit using securities like guarantee.

- Large pools of assets can provide access to institutional products and to investments that are not available to individual investors.

- Private Funds allow you to analyze the investment portfolio on a consolidated and steady basis.

Advantages of an investment fund in Russia

Safety

- Prohibition on foreclosure on assets of Mutual funds on debts of unit holders or operating companies.

- Protection from bankruptcy of the Mutual Fund.

- Assets security

- Reliable legal mechanism

- Additional sales channels

- Tax-free reinvestment

- The absence of double taxation

- The ordering of ownership of assets between owners

- Repatriation of capital, departure from CFC

- Raising the status of the company

Differences between a PIF and a Trust

A Trust in General (Anglo-Saxon) law is a system of legal relations, in which property, originally owned by the founder, is transferred to the trustee, and income from it is received by beneficiaries.

In Russia (as a system of continental law, unlike Anglo-Saxon), Mutual Investment Funds (UIFs or PIF in Russian) operate instead of Trusts, in European countries it is SIF.

Throughout the European Union, the UCITS (Undertakings for the Collective Investment in Transferable Securities) is used to provide a high level of protection in accordance with the European Directive 2009/65 / EC of 13.07.2009. This directive describes common rules for regulating open funds that invest in securities (stocks and bonds). The directive regulates the organization, management and supervision of such structures as funds, and also defines the rules regarding diversification, liquidity and the amount of borrowed funds.

In Russia, Mutual Investment Funds (PIF) are regulated by the Federal Law “On Investment Funds.” No. 156-ФЗ.

The shareholder - the creator of the PIF is the beneficiary, just like in a Trust.

The Trustee is a management company that has a banking license.

Like a Trust, PIF is not a legal entity, but is considered as property in the form of an investment under the management of a specialized management company licensed by the Central Bank of Russia.

Instead of an agreement with a Trustee, a PIF adopts Trust Management Rules (PDU in Russian), which are registered with the Central Bank of Russia.

The specialized management company is an independent legal entity with certified professional managers and has its own assets of at least 20 million USD. In addition, the specialized management company is personally financially responsible to the Fund Shareholders.

The main difference from the Trust is that the PIF maintain mandatory reports to the Central Bank of Russia, which is the control body.

There are basically no other differences, a PIF is essentially the same thing as a Trust.

How can foreigners establish or invest in a PIF

A mutual investment fund (PIF) is a pool of property of persons and legal entities, managed by a specialized management company. All property that makes up a PIF is in a shared ownership of the participants of this fund. The PIF itself is not a legal entity.

The property of the specialized management company is separate from the property of the PIF and is accounted for on a separate balance sheet. The relations between the participants of the investment fund and the management company are regulated by the legislation on investment funds and the rules of trust management of a particular fund (registered by the Bank of Russia) which have the status of a trust agreement.

A combined PIF may be of a closed type, its units are intended only for qualified investors.

Just like for residents, a shareholder can be a person who has been qualified as an investor. For a foreign citizen, as well as for a Russian citizen, it is enough to show a bank statement that there is at least 100 thousand USD on the account.

It is not necessary to go through a qualification procedure for a foreign company.

How do I know my money is safe?

- A share in the right of ownership of a PIF is certified by a security, the records of which are maintained by a specialized institution of the Bank of Russia. There is a statutory ban on the collection of debts of the Shareholder from the property of a PIF.

- There is no information on the holders of investment shares in public registers.

- PIF reports of a certain category are not disclosed.

- For additional control, the PIF has an investment committee, where shareholders can appoint their attorneys (the mechanism is similar to the status of the protector in a trust).

- All assets are controlled and supervised by the Central Bank of Russia; it is not possible to alienate property from mutual funds without the consent of the shareholder (beneficiary).

What are the benefits of investing in Russia for foreigners?

1- A PIF can invest in almost anything. There are no strict restrictions:

- Bonds, stocks, financial instruments, other funds, other SIFs, funds of funds, structured products, ETFs, derivatives (guarantees, options, futures, etc.).

- The PIF can implement any hedging strategies (CTA, long / short, Global macro, systematic, event-driven, market development, side risk protection, futures management, Technology, etc.).

- Real estate (commercial, private, directly or indirectly).

- Private investments (stocks, loans, funds, etc.).

- Long-term (debts, securitization, venture funds investing in undervalued companies) currency, precious metals.

- “Green” investments or projects, micro financing.

- Works of art, cars, jewelry and wine collections.

2. It is not possible to collect property of PIFs.

- The legal basis is the norm of the Civil Code of the Russian Federation. This norm states that it is impossible to foreclose property that is held in a trust, for the debts of the trustor (owner of investment shares) or the manager himself (specialized Management Company).

3. Shareholder information is confidential and not public.

- Depending on the residence of the shareholder, a full exemption from taxation or preferential tax treatment is possible. No taxation on income from the PIF.

4. Beneficiaries are closer to the money. Unlike ordinary legal entities, the list of shareholders is not public information, that is, intermediate structures don´t need to conceal or mediate their control over assets, which entails additional tax and other costs

5. Assets for government officials. Trust management status allows holding assets, when the possession is not directly allowed or “not recommended” for government officials.

6. Doing business with a PIF or within a PIF is inevitably associated with the implementation of a number of standards and requirements supervised by the Central Bank of the Russian Federation. For counterparties, this is a sign of lower risks and greater reliability.

Choose solutions for your private Fund

Example 1

Fund use to convert Family Office to Multifamily Office

Task: Family Office comprising single family assets plans to offer investment ideas thereof to external investors, such as other close families and friends.

Solution: Private fund

Example 2

Liquidity Management and Dynastic Planning Task: Large family business is on sale and head of the family intends to manage newly liquid consolidated family assets, while allocating asset beneficial ownership to individual family members of different generations within a comprehensive succession planning.

Solution: Private fund

Conversion of a private investment company to a Private Fund Task: An investor uses a simple offshore investment company to manage their account, that leads to total dependence on the broker for portfolio valuation, liquidity and control issues and lack of transparency in fees.

Solution: Private fund

Example 4

The investment club intends to apply more professional approach Task: a group of friends intends to invest together. To avoid potential conflicts while co-investing, friends offer to adopt clear rules and responsibilities within the investment club in advance.

Solution: Private fund

Steps to establish an investment fund in Russia

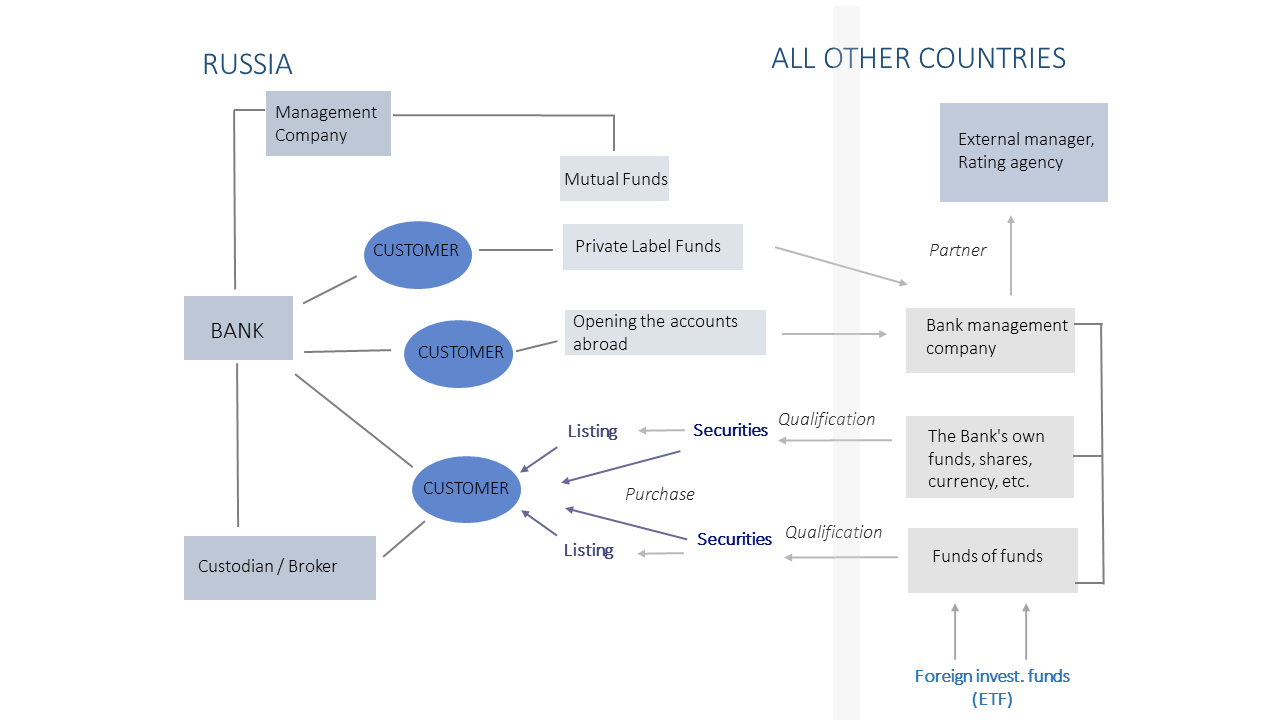

Step 1: Choose foreign jurisdiction to incorporate the fund, Luxembourg, Liechtenstein, Cyprus, Ireland, Iceland, Netherlands

Step 2: Choose the asset management company and the fund administrator

Step 3: Establishment of the group of foreign funds

Establishment of a Fund \ Funds (to purchase ETF and other existing funds with high reliability rating in any country of the world)

Establishment of real estate mutual funds and stress funds (mortgage real estate) for Investors abroad

Establishment of mutual funds for investments abroad for individual categories of investors

Step 4: Choose the external manager

EAM (External Asset Managers) The bank delegates part of its functions and associated risks to external managers.

An external asset manager provides references in terms of the investment process and manages the same under the client's power of attorney but does not serve as the assets holder.

Assets safe custody may be ensured by the bank only. Therefore, external asset managers and banks act jointly, cooperating and complementing each other.

The external asset management account holder is serviced by both a bank manager and external asset management company. Therefore, the service is not limited to the standard bank working hours. In addition, the client has access to investment and financial analysis results of both parties at once, which allows to have the most complete picture of the current situation in order to make effective investment decisions.

Step 5: Introduction of the bank fund`s securities into the market

Option 1 - qualification with the Central Bank of the Russian Federation and subsequent listing on stock exchanges in the Russian Federation

Option 2 - qualification with the Central Bank of the Russian Federation without listing

Option 3 – securities offer on the foreign stock exchanges

Option 4 - display of OTC transactions

- Qualification of the Fund's securities with the Central Bank of the Russian Federation

- Establishment of agency relations with a foreign depository for a foreign investment fund

Step 6: Trading through brokers

In Russia: Through brokers and custodians in Russian Federation

Abroad: Through partners - foreign brokers (custodians)

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

Another week has passed in the universe of the Bosco conferences. This year, we have chosen two key ...

When international business structures are discussed, the United Kingdom often comes to mind. For ye...

When global markets tremble under inflation, currency swings, and economic uncertainty, the search f...

In our section “Plans for the Weekend”, we've talked about museums, fortresses, neighborhoods, histo...

On September 29th, Mundo will embrace the world of B2C: Turkey is the scenario for the InvestPro con...

In our view, building a strong B2B network is almost as important as meeting reliable and long-term ...

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)