I had a friend who used to say: better be safe than sorry. At Mundo, we completely share this philosophy, and that is why we recommend our readers to use asset protection structures.

In Panama, you can set up a very efficient structure using all its tools like Sociedad Anonima, freezone companies, you can create branches of your company so that you can optimize your tax burden and grow your business. These are undoubtedly all great things but what would happen if, god forbid, you find yourself going through a nasty divorce or suddenly chased by creditors over false charges.

Nobody likes to think about these things, but the truth is that they might happen, and you may find that you have lost in one week everything you worked so hard to build for decades. Luckily, Panama offers one of the best asset protection tools in the world: The Panama Foundation.

Don´t be sorry. Be safe with a Panamanian Foundation and read along to find out more about this structure.

Panama modelled its Foundation law exactly on the laws of the Lichtenstein Foundation, except that Panama is far cheaper and does not levy any form of inheritance taxes. The foundation is the perfect asset protection vehicle and, so far, no Panamanian court has ever set aside a properly established foundation.

Assets held by a foundation, including real estate, shares, bonds, precious metals and other property, cannot be seized by creditors, governments or even spouses in divorce proceedings.

The foundation can be fully controlled via a protector, which is a physical or legal entity acting under the authority of the person who established the foundation, protecting their interests and the interests of the beneficiaries.

In practical terms there is not much difference between a foundation and a trust except that the foundation is a legal entity.

It is advisable to use a foundation to hold a Panamanian company for rock solid asset protection and confidentiality.

Difference between a foundation and a trust

The trust and the foundation are very similar in practice as they are both based on this principle: the assets, previously owned by someone, are transferred to a person or entity that will look after them and protect them, for the benefit of a third party.

Basically, we have three places:

This is how basically a trust and a foundation work. But these structures have some differences.

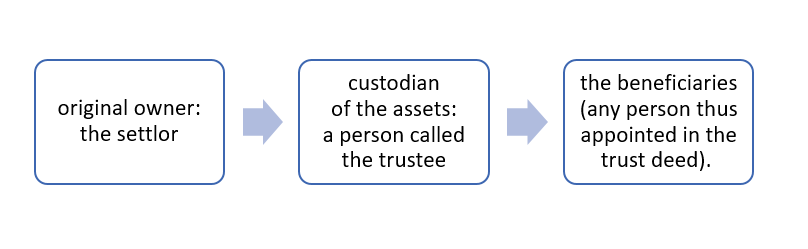

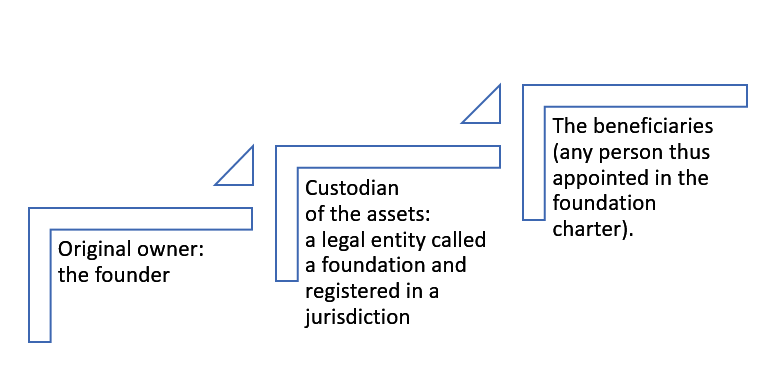

The trust is an agreement between two people, a settlor (owner of the assets) and a trustee (custodian of the assets), while a foundation is a legal entity and as such must be registered in a jurisdiction and under the laws of this jurisdiction.

This is how the three places would look in each case:

Trust

Foundation

In the case of a foundation, it is the founder who does the first contribution to the foundation, and after this there can be other contributors as well. In Panama, for example, the first contribution must be of 10,000USD that can be in cash or in the form of company´s shares.

These assets will now belong to the foundation and will be administrated for the benefit of the beneficiaries.

Who may these beneficiaries be? This is up to the founder and it´s established in the foundation charter. The founder can choose as beneficiaries any member of his/her family or friends.

What is a foundation useful for?

A foundation, exactly like a trust, is a tool that´s used for asset protection purposes. Due to the fact that the assets are owned by the foundation, they cannot be seized. This means they are 100% protected from possible threats like bad divorce cases, false claims, creditors, etc.

Foundations are also useful for inheritance organization. Let´s suppose you have worked your whole life to build your business, you have properly set up the headquarters in Panama and the branches abroad, your tax structure is optimized and in full compliance, but what will happen with all this after you are retired?

Let´s suppose your heirs enter into conflict or disputes over the heritage, over how to continue with the business or other similar issues. This is easily solved with a foundation because, as the founder, you can establish in the charter how exactly the assets will be used and distributed. This can undoubtedly save you many headaches now and in the future.

If you choose the Panama foundation, you can rest safely knowing that your assets are strictly protected by the Panamanian law, and nobody will be able to seize them.

Panama foundation: confidentiality

Private Interest Foundations have the highest levels of confidentiality taking into consideration different aspects: the foundation regulations are not registered before any authority and they contain the information about the beneficiaries, protector and distribution of the assets under the foundation. The Private Interest Foundation Law enshrines the foundation secret, that is, the duty of confidentiality (under penalty of civil and/or criminal sanctions) to the Members of the Foundation Council and the supervisory bodies, if any, as well as the public or private officers who had knowledge of the activities, transactions or operations of the foundations. The provisions of this article shall apply without prejudice to the information to be disclosed to the official authorities, and the inspections to be carried out by them in the manner established by law.

Due to its high confidentiality level, many wealthy families choose the Panama foundation as an asset protection structure, knowing that their information is protected by law and will not be disclosed nor exposed to public records.

Great tax optimization tool

If the Foundation has assets outside of Panama, it is exempt from the payment of taxes in Panama. There are no restrictions as to the nationality of the founder, beneficiary, foundation council or protector. The Foundation´s Law establishes that they can be Panamanian or foreign. It is not strictly necessary to have tax residency in this case, but we recommend it as a properly established tax residency is the best way to structure an asset protection strategy. Also, although Panama won’t take taxes from the foreign assets owned by the foundation, other countries such as your original country of citizenship may ask at some point for a tax compliance document. This is especially necessary if you want to buy properties or invest in other jurisdictions outside of Panama.

Panama Foundation + Panama company: an unbreakable structure

We have established that the foundation is a legal entity that´s registered under Panamanian (or other) jurisdiction. Now the following question arises: what is then the difference between a foundation and a company?

It is as simple as this: A company has owners; a panama Foundation is not owned by anyone.

Let´s explain further. When you register a company, you need to issue shares in order to estipulate who is the owner or owners of the company.

A foundation doesn´t require shares to be established, it does require, though, an initial contribution, whose amount will depend on the jurisdiction´s requirements.

A foundation is an absolutely autonomous entity. Nobody owns it.

Your panama foundation is an independent structure that owns your assets. Logically, since these assets are not owned by you anymore, nobody can seize them from you. But still you can choose who will benefit from them.

Panama Foundation: what can I do in a practical sense?

The Panama foundation can hold any assets as long as they are legal. Literally any assets, but it´s not allowed to carry out commercial activities of any type.

What does this mean? How can I best use my Panama Foundation?

Well, while your Panama Foundation is not allowed to carry out commercial activities, it can, however, receive profit from dividends. It can have brokerage accounts and regular bank accounts, which means it can receive dividends from passive investment, bonds, equities, etc.

Your Panama Foundation can also own an apartment or several apartments. If you give these properties for rent, you can benefit from the rent profits and this is completely legal and extremely convenient. Remember we are talking about a country like Panama with very fertile soil for tourism business. Panama is full of tourists that come to visit the breathtaking Caribbean and Pacific beaches, the mountain landscape and delicious coffee in Volcan and David, the interesting and cosmopolitan lifestyle of the capital city. Moreover, many Europeans and Americans choose Panama as a touristic destination because the prices are really low in Panama for their standards.

Let’s picture a situation. Your foundation owns, let´s say, three apartments, one in Bocas del Toro, another one in El Cangrejo (Panama City) and a third one in Volcan. You can rent these properties and the profit will be safe and sound under the foundation´s ownership.

Creditors? They won’t be able to touch them.

An angry ex-wife? She won´t be able to put her hands on them.

Spoiled and troublesome heirs? They will have to use the profits as established and stated in the foundation charter.

The unbreakable structure

And now the cherry on the desert. We have established that the Panama foundation can receive profits, and this includes profits from a company. We have established that the Panama foundation can own any assets, and this includes company´s shares. Indeed, your Panama foundation can own a company and receive the dividends from it.

And thus, we close the circle to form the perfect structure, this is: the perfect circle of the perfect asset-protection-optimization structure.

Let´s paint the whole picture of what your life can be like in Panama.

- You establish the center of operations in any of Panama´s freezones (please consult the freezone section to find out all the benefits).

- Then, you establish branches in other countries where you will do the trading and earn the profits. If properly structured, you will tax at a 0% rate.

- With the help of Mundo´s experts, carefully structure your audit reports and tax reports and transfer pricing between your cross-bordered companies.

- Put the company under the foundation´s control and ownership, and sleep at ease knowing that your structure is protected by one of the strongest and most confidential legislations in the world.

- Properly establish your residency and tax residency and enjoy a cold Balboa (national beer) in Casco Viejo or on an island in bocas del Toro.

Now the circle is closed, and you have got a strong and confidential UNBREAKABLE structure.

Panama or Liechtenstein?

Liechtenstein is considered to be the perfect jurisdiction for establishing a foundation. In terms of assets protection and confidentiality there is only one jurisdiction that comes close to Liechtenstein and this is Panama. Like we have pointed out before, Panama´s Foundation requirements and characteristics were inspired by Liechtenstein´s.

However, having the same advantages, a Panamanian foundation is much more cost-effective, and it opens up a wider range of possibilities thanks to the country´s advantages in an of itself. Panama is a powerful business hub thanks to the Panama Canal, to its strategic location as bridge of the Americas, to its tax incentives and territorial tax system and to the Freezone possibilities.

Mundo chooses Panama over Liechtenstein and in this section we will explain why. Firstly, let´s take a look at this comparison chart we have prepared for you.

|

Panama |

Liechtenstein |

|

|

What law applies? |

Private Interest Foundation Law 1995. |

Persons and Companies Act 1926 (as amended). |

|

What is the regulatory board? |

Panamanian Government Public Registry. |

Liechtenstein Office of Land and Public Registration. |

|

What is the initial asset required? |

USD 10,000 (cash or assets). However, a foundation can be set up without assets if there is a commitment that assets will be transferred after the foundation is set up. |

CHF 30,000 (cash or assets). |

|

How much is the registration fee? |

USD 350. |

Up to CHF 700, depending on the type of foundation. Private interest foundations merely deposit the foundation charter with the Public Registrar (for declaration purposes). Charitable foundations (as well as combined) only come into effect when they are entered on the Public Registry. |

|

How much is the annual fee? |

USD 400. This must be paid to the government as Annual Corporate Franchise Tax. |

0.1% of the nominal capital and net asset value or a minimum of CHF 1,000. 0.075% on net asset value above CHF 2,000,000. 0,05% on net asset value of CHF 10,000,000 and above. |

|

Who can be the regulated person? |

An attorney or law firm needs to be the Resident Agent, who must countersign the foundation charter before its registration in the Public Registry. |

The representative has to be at least one member of the council with a qualified professional background and residence in the territory. He or she will be authorized to manage and represent the foundation. |

|

Who can be a council member? |

Any person (individual or corporate body) domiciled o resident anywhere in the world can be a council member. The minimum number for corporate bodies is 1, and 3 for natural persons. |

Same as above. |

|

Is there a guardian or protector? |

It is an optional role in charge of advising over the foundation’s activities. In case there is appointed, it should be stipulated in the foundation charter. The founder or council can decide the specific powers. |

The protector is the representative of the beneficiaries and ensures that the board is acting according to the purpose of the foundation. It is not mandatory and should be defined in the statutes. |

|

Can it be migrated? |

A Panamanian foundation may migrate to another jurisdiction. |

A Liechtenstein Anstalt or Stiftung may continue in a foreign jurisdiction. However, there is a charge of CHF 600 to complete this process. |

|

Can it be merged? |

There is no ability for a Panamanian foundation to merge with any other entity. |

There is no ability for an Anstalt or Stiftung to merge with any other entity. |

|

What are the beneficiaries’ rights to information? |

The rights of the beneficiaries are set down in the foundation by laws or by resolutions passed by the foundation’s council. If a beneficiary suffers a violation of his or her rights by a supervisory body, he or she may directly bring a judicial action before the proper court in the foundation’s domicile. |

The information rights of beneficiaries can be legally restricted by transferring those rights to other bodies (such as an internal controlling body) to carry out supervisory duties. In such cases, the rights of the beneficiaries can be limited to a minimum (their own rights, the foundation’s purpose, the organization of the foundation). In the case of charitable foundations, the beneficiaries have no information rights as these are generally under authorities’ control. |

|

Is there any information publicly available? |

The charter is the only document that is publicly available, which details: -Name of the foundation. -Initial patrimony. -Purpose, duration, and domicile of the foundation. -Assets’ distribution on liquidation or dissolution of the foundation. -Name and address of council members and details of the Resident Agent. |

The charter (known as the statute) is the only document that is publicly available, which details: Name of the foundation. Initial dedication. Foundation’s purpose. Date of establishment and duration. Appointment and functioning of the foundation council. Identity of founder or agent. |

|

Are charitable purposes allowed? |

Yes, it is possible to have a charity foundation. |

Yes, it is possible to have a charity foundation. |

|

What role can be played by a corporate body? |

A corporate body can act as founder or a council member. |

A corporate body can act as the founder, council member, or the protector. |

By looking at the chart, you will see that both structures are quite similar. However, there is a big difference that stands out: costs. Just a quick glimpse and you will realize Panama offers a more effective solution.

For example, registering a foundation in Panama is three times less expensive (USD 10,000) as it is in Liechtenstein (CHF 30,000). The same goes to the fees, while the Caribbean country requires only USD 350, Liechtenstein asks for more than the double; even the annual fee falls into the trend.

This is one of the main reasons why we recommend Panama. You will enjoy a powerful structure enhanced by the country’s opportunities while still protecting your wallet.

For info pack and consultation inquire here

Click here to read our interview on Panama foundations with our expert

$170,000

$2,500,000

$350,000

$1,400,000

$395,000

When the Panama Canal connected two oceans, global trade routes found a new rhythm. Today, the count...

Panama may be many things, but it certainly is not dull, especially in the real estate sector. Besid...

When the Mundo staff heard about the cities chosen by Bosco for their international conference optio...

The modern world often feels like a maze of routines and crowded spaces. Cities shape our time, dict...

Another week has passed in the universe of the Bosco conferences. This year, we have chosen two key ...

When international business structures are discussed, the United Kingdom often comes to mind. For ye...

.png.small.WebP)

.png.small.WebP)

.png.small.WebP)